Developers of small, modular nuclear reactors have received increased venture capital investment from technology companies seeking carbon-free energy.

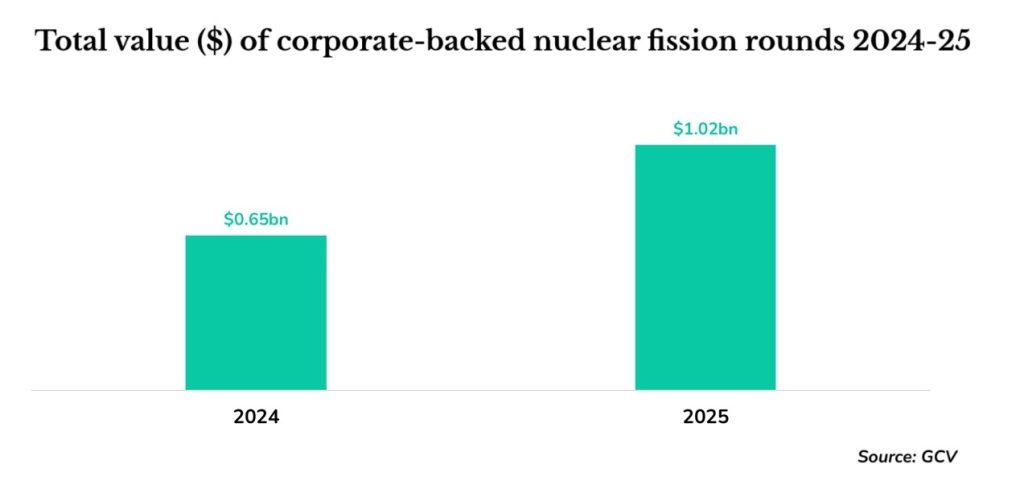

Corporate-backed VC funding of small, modular nuclear reactors and related technologies has surged 58% so far this year as demand grows for fossil-fuel free energy to power AI data centres.

VC investment in nuclear startups where a corporate is on the cap table totals more than $1bn so far in 2025, compared with $645m in 2024.

Recent large funding rounds for nuclear reactor technologies include the $650m raised in June for TerraPower, a US developer of low-cost nuclear plant technology, and the $165m series C round for Radiant, a US maker of nuclear microreactors.

Some of the corporate backers for nuclear technologies are non-energy companies, reflecting how the sector is attracting investor interest from heavy users of energy such as technology companies. US chipmaker Nvidia was part of the fundraising for TerraPower, while Amazon was an investor in the $500m series C round in October 2024 for X-energy, a developer of small module nuclear reactors.

Corporate-backed funding rounds for nuclear startups since 2023

Track all corporate-backed startup funding rounds across different sectors in the CVC Funding Round Database

In the past decade, nuclear energy had fallen out of favour because of the threat of accidents such as the 2011 meltdown of the Fukushima Daiichi nuclear power plant in Japan, which leaked radiation following an earthquake and tsunami. Low gas prices also led to a surge in investment in natural gas plants to the detriment of nuclear plant upgrades.

But the sharp rise in demand for electricity for data centres powering the rollout of AI has resulted in the nuclear sector experiencing a renaissance, as tech companies scramble to secure sources of baseload energy that doesn’t emit greenhouse gases.

Last year, Microsoft entered into an agreement to buy power from a planned reopening of a nuclear reactor at Three Mile Island, the site of the US’s worst nuclear disaster. The tech company will use the power for its AI applications.

Building traditional nuclear power plants can run into billions of dollars. The newer microreactors that are receiving VC investment provide cheaper and more efficient designs but produce less power than the bigger plants.

In September the US and the UK agreed to partner on developing and deploying advanced nuclear reactor technologies. The Atlantic Partnership for Advanced Nuclear Energy is expected to speed up construction of nuclear power plants. It also supports research in nuclear fusion technology.

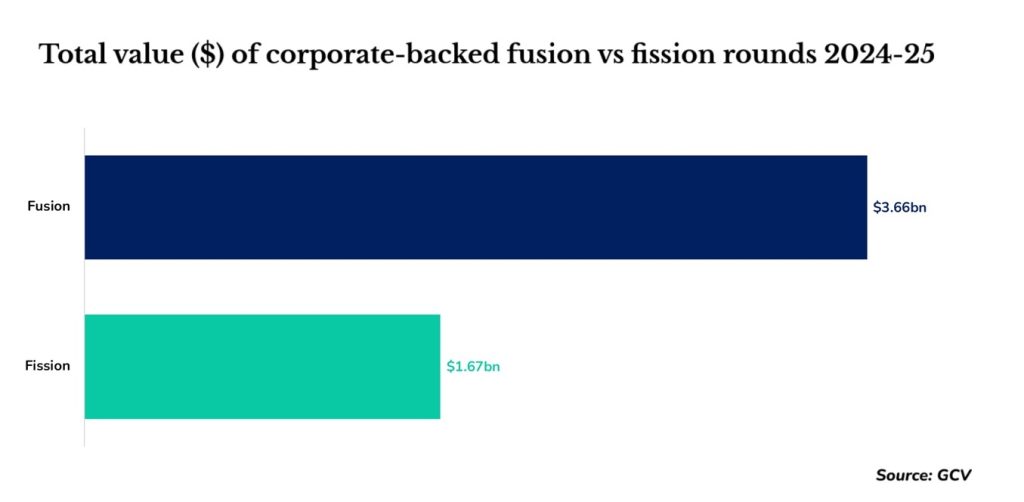

Venture-backed funding for nuclear fission technology is still dwarfed by VC investment in fusion, a less mature technology that involves the combining of atomic nuclei to release a much larger amount of energy with less radioactivity than fission. Fusion-based power is still several years away from being available even in demonstration plants, much less commercial-scale operations. Nevertheless, recent breakthroughs have encouraged more corporations to back the startups developing nuclear fusion projects.

Total corporate-backed investment in fusion startups between 2024 and 2025 was $3.7bn, according to Global Corporate Venturing data. This compares with $1.7bn for nuclear fission startups in the same period.

CVC investors we need your help!

The corporate venture industry has never been more influential — but it is also changing rapidly. Help us track these shifts by adding in the details of your unit to our annual survey.

All responses are anonymised and we share the benchmarking data back with all respondents.