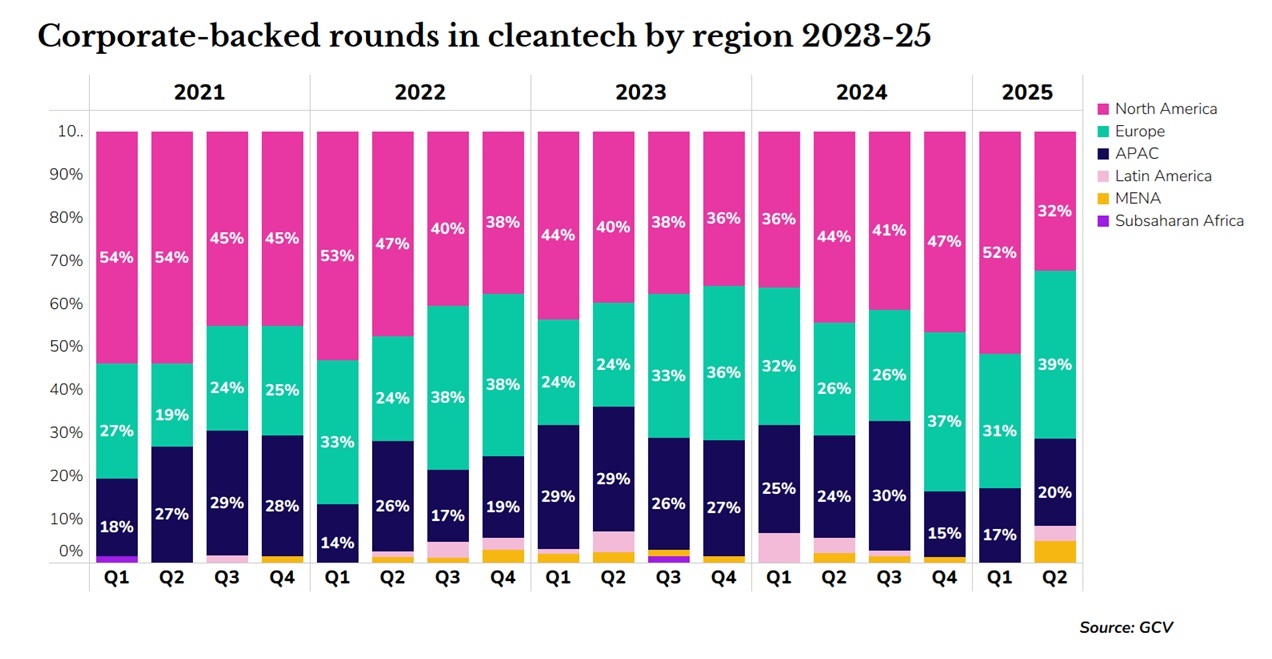

The percentage of corporate-backed VC funding for US cleantech startups fell to its lowest quarterly level over the past four years.

The portion of corporate-backed venture capital funding for US cleantech startups fell in the second quarter of 2025, a sign the country is losing its position as champion of climate-related technologies.

US startups received just 32% of all corporate-backed VC funding rounds in the cleantech sector in the second quarter of 2025, the lowest quarterly percentage over the past four years.

While funding for US cleantech has dropped, corporates have ploughed more money into Europe, which received 39% of all corporate-backed cleantech funding in the second quarter of 2025, its highest percentage since 2021.

The drop in funding for US clean energy comes as the US administration under president Donald Trump leads an anti-climate agenda, calling for increased production of fossil fuels and cutting subsidies for green energy that were part of the Inflation Reduction Act. The legislation was passed by former president Joe Biden in 2022 and pledged nearly $400bn of government grants and subsidies for clean energy.

Europe, on the other hand, is viewed as a more stable environment for cleantech investment as governments have largely stuck to climate targets.

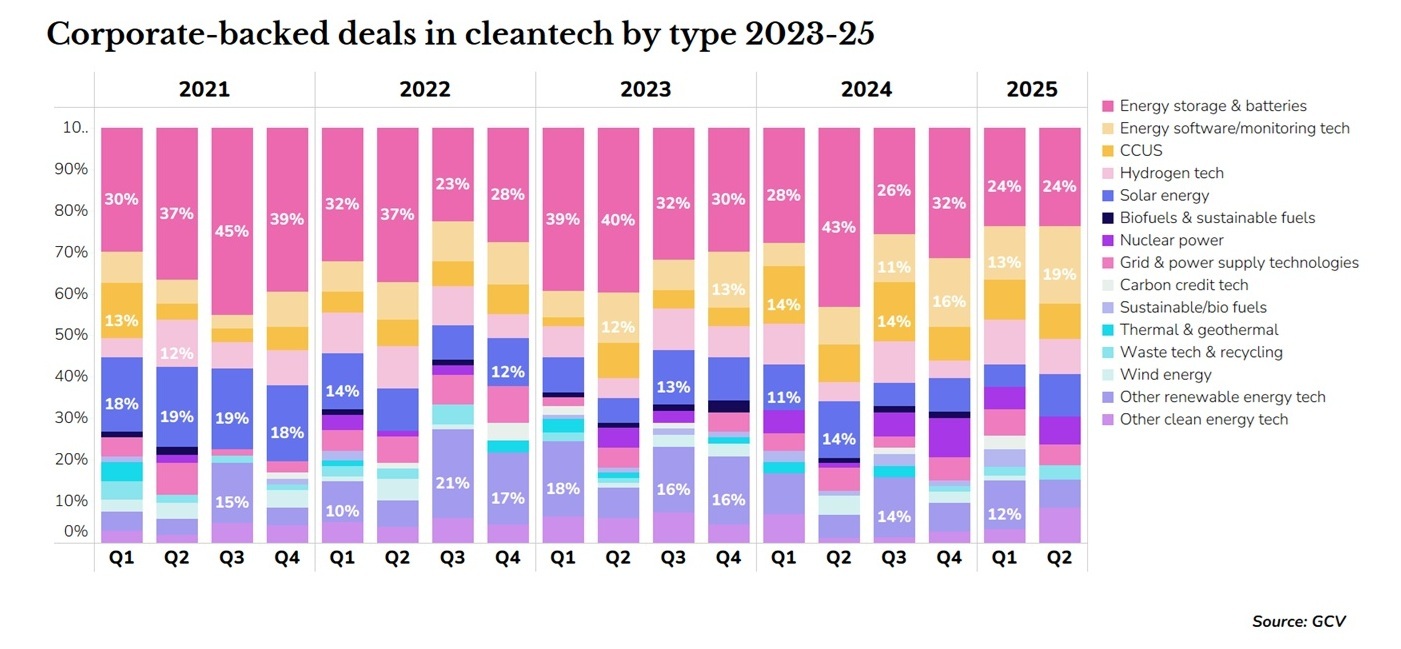

Corporate-backed renewable energy deals in July include the $4.8m fundraising for Hydroleap, a Singaporean green wastewater technology developer backed by Woh Hup, a Singapore-based construction and civil engineering company, and the $16.3m seed round for Stellaria Design, a French startup making small modular nuclear reactors, backed by European corporates Technip Energies and Schneider Electric.

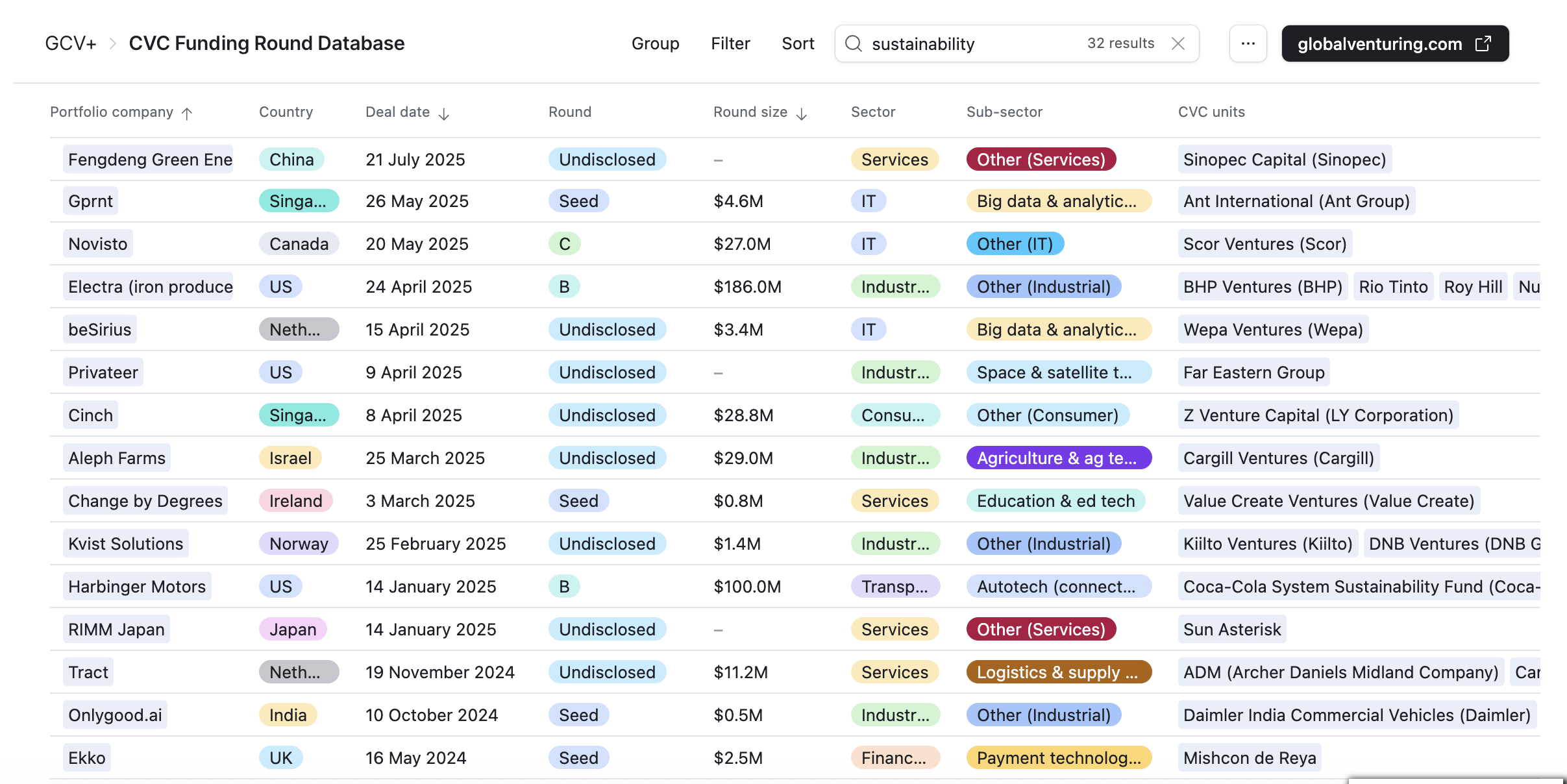

Search our CVC Funding Round Database for all the deals since 2023 related to sustainability and green energy.

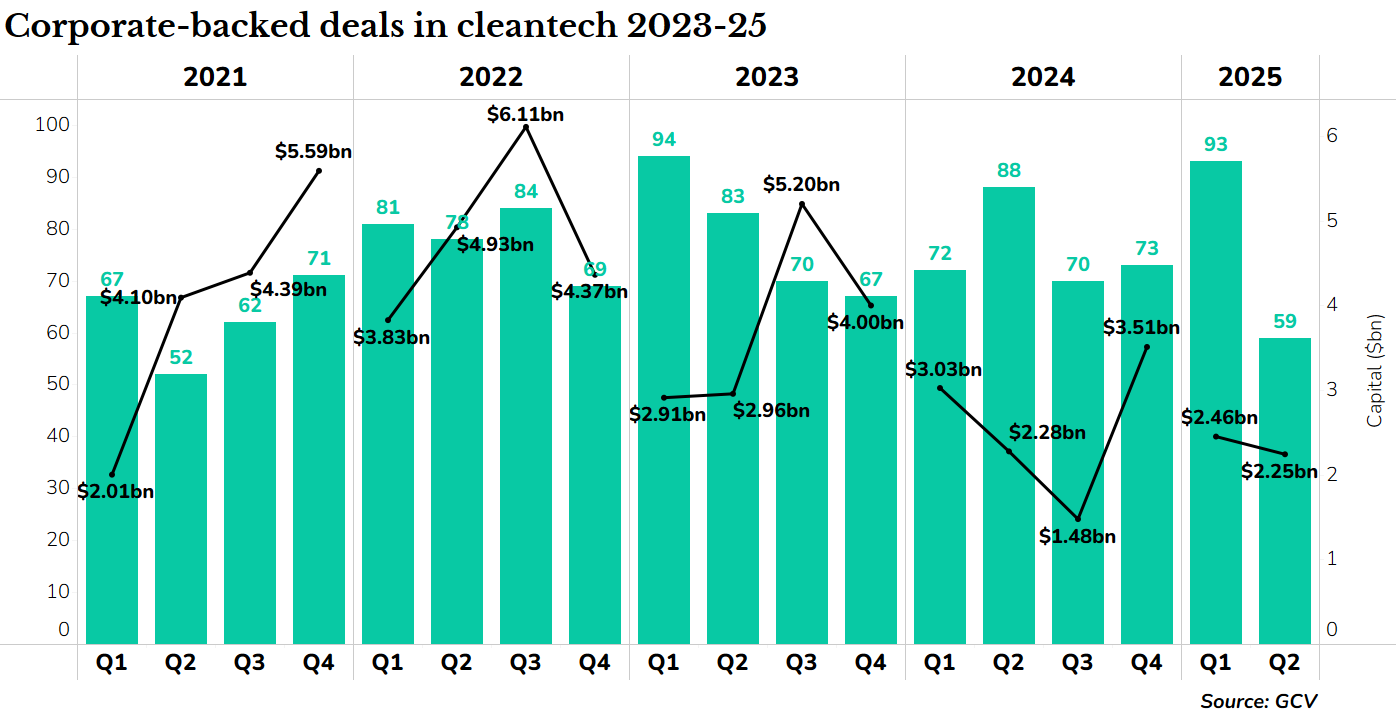

The value of corporate funding for cleantech startups overall has been on a downward trend since the third quarter of 2022 when it peaked at $6bn. The value of deals last quarter was $2.25bn, roughly the same as the same quarter in 2024, but the number of startup financings is down 33% compared with a year ago.