Deep-pocketed US corporates spent big as the AI frontrunners raised billions, while others became AI-centred and sectors like energy got a boost.

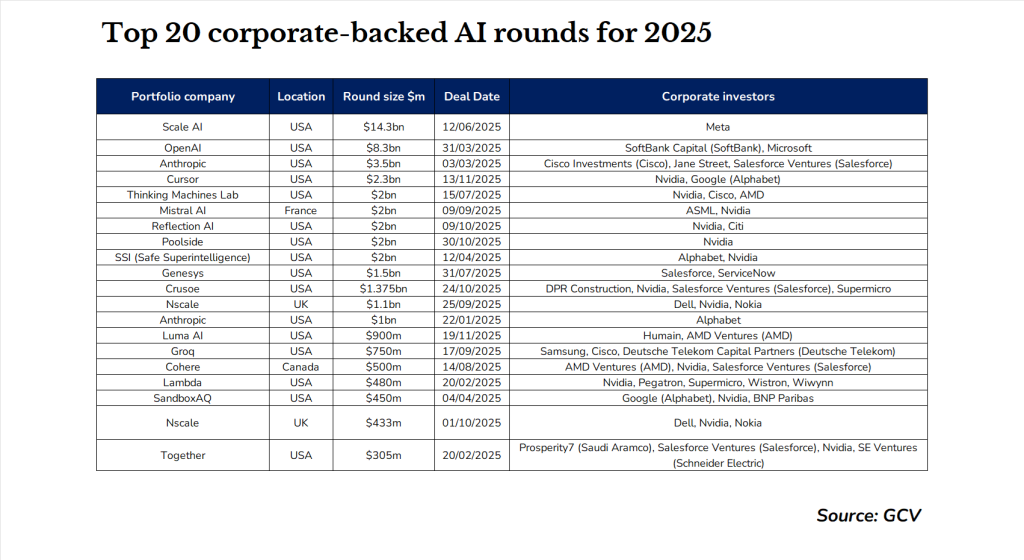

2025 was the year when startup funding rounds genuinely stratified, with 22 corporate-backed funding rounds sized at $1bn or more, according to GCV data – half of which hit the $2bn mark.

That figure doesn’t even include funding deals like Disney’s recent $1bn licensing-for-equity commitment to ChatGPT creator OpenAI, or the $4bn Databricks is currently raising, at a colossal $134bn valuation. The artificial intelligence race is raising the fundraising bar, but not just for the biggest names in the industry. There are implications for adjacent sectors and for a group of corporate investors that have now taken their place firmly at the top rung of CVC.

The artificial intelligence boom is taking VC rounds to new heights

The list of 2025’s biggest corporate-backed funding rounds is dominated by AI software, with nine of the 11 biggest rounds this year being pure-play AI developers. The biggest funding round was Facebook owner Meta paying $14.3bn for a 49% stake in Scale AI, but OpenAI and Anthropic both carried on their huge-scale accumulation of capital and were joined by the likes of Cursor, Mistral and Poolside.

One factor that sticks out from that list is its domination by the US – 16 out of the 20 largest AI rounds this year were for US companies, solidifying Silicon Valley’s place as the world’s AI centre.

European hubs like London and Paris are represented but they can’t match the numbers of massive startups in the US. One reason China’s AI sector, which focuses more on robotics and embodied intelligence, doesn’t feature is that it does not benefit from the same array of deep-pocketed corporates as the US, in addition to export controls on AI chips that make it very hard to match the computing power of their western counterparts.

Nvidia featured in 13 of the 20 largest AI rounds this year, with Salesforce, Cisco and Google owner Alphabet also prominent.

Corporate venture capital investors have made their presence very deeply felt in AI in recent years, with a small group marking themselves out as ready to invest big in the frontrunners. Nvidia featured in 13 of the 20 largest AI rounds this year, with Salesforce, Cisco and Google owner Alphabet also prominent, either directly or through their venture units.

That activity mirrors the increasingly fierce competition between the large tech operators on a corporate level, as many of them seek to steal away each other’s key staffing hires and boost their own AI capabilities. While some have developed their own proprietary platforms, such as Google with Gemini or Microsoft with CoPilot, many of the others are opting to partner with big-name startups, leading to some huge one-off deals.

All of these (rounds) could be dwarfed by the potential terms of a deal that could involve Nvidia investing up to $100bn in OpenAI.

Meta’s investment in Scale came after Google invested $1bn in Anthropic in January, two months after Amazon made its own multibillion-dollar commitment to the startup. Those follow huge investments from Microsoft and SoftBank in OpenAI, and all of these could be dwarfed by the potential terms of a deal that could involve Nvidia investing up to $100bn in OpenAI as part of a data centre build-out that would use Nvidia chips.

The real sign of how heated AI investment has become was Thinking Machines shattering the seed round record by raising $2bn from the likes of Nvidia, Cisco and chipmaker AMD just four months after it was founded, with no official product, on the strength of CEO Mira Murati, formerly OpenAI’s chief technology officer.

But with the large tech corporates continuing to pull in net profits well into the 11 figures on their balance sheets each quarter, this pace shows no sign of slowing yet.

AI is making ripples everywhere

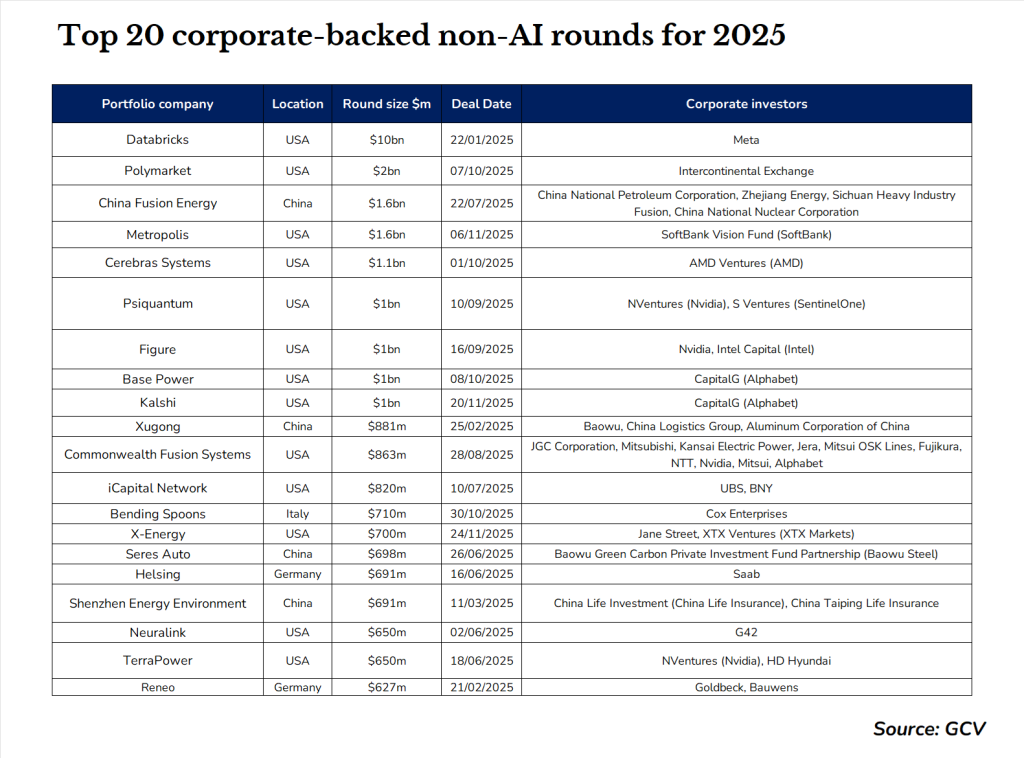

Startups that have embraced AI wholeheartedly are also raising large rounds. Data analytics software producer Databricks, for example, closed a $10bn Meta-backed series J round in January valuing it at $62.5bn. That valuation looks set to be doubled in its next round.

Metropolis, which still counts a parking lot payment platform as its core business, pulled in $1.6bn last month as it pivots to building an AI-equipped computer vision system. That came a few weeks after Cerebras Systems secured $1.1bn as it builds up an offering combining chips, hardware and cloud services that targets AI customers. Figure, a developer of humanoid robots using AI processing technology, raised $1bn itself in September.

Energy companies are now explicitly pitching their technologies as data centre-focused.

The need for a vast infrastructure of power-hungry data centres to serve the AI industry is also supercharging energy technology. Renewable energy startups have found the going harder in the US where the regulatory system has turned less friendly, and in general many energy companies are now explicitly pitching their technologies as data centre-focused.

Less than three years old, Base Power is the kind of startup tackling this new reality, pulling in $1bn through an October series C round featuring CapitalG, for a distributed storage model intended to protect against blackouts. That’s an especially big issue in Texas, where Base is headquartered, which is especially vulnerable to blackouts given the influx of data centres into the state.

Nuclear is where much of that growth is coming at early and growth stage. State-backed startup China Fusion Energy secured $2bn in the largest CVC-backed energy round of the year, while Commonwealth Fusion raised $863m. Those fusion technology developers are joined in the list by X-Energy and TerraPower, which are working on modular nuclear reactors that could be used as data centre energy sources.

Looking at the CVC investors in these rounds, some are from traditional energy and industrial areas, but more notable are Nvidia and Alphabet, companies which need to power data centres, as well as large quantitative trading firms XTX and Jane Street, which now need so much computing power for their trades that energy has become a strategic investment area for them.

Global instability fuels funding for emerging areas

Lastly, some of the remaining names in the list are notable for attracting large sums of money due to geopolitical instability.

One of those areas is defence tech. Helsing, a European developer of AI autonomous defence technology, recruited Saab for a $691m round in June, against a background of broadening tension between Russia and the rest of Europe amid the ongoing Ukraine war.

Polymarket and Kalshi are surging for a different reason, running online prediction markets that essentially allow anyone to bet on general world events that seem to be getting less predictable by the day. Their business model represents a loophole in US gaming laws, but their platforms are also a new information class that reflects public sentiment (or the sentiment of its users at least) on a daily, or even hourly basis.

[Polymarket and Kalshi’s] growth rates dwarfed everyone else this year.

Their growth rates dwarfed everyone else this year. Polymarket raised money at a $350m valuation less than 18 months ago; by October it was a $10bn company, having secured $2bn from financial exchange operator Intercontinental Exchange. Kalshi’s $1bn round in October was its third of the year, taking it from a $2bn valuation as recently as June to $11bn just four months later. Look for these two to feature heavily in this list next year.

Finally, there is one more area expected to play a bigger part in this list as the years go by: quantum computing. PsiQuantum received $1bn from investors including Nvidia’s NVentures and SentinelOne’s S Ventures units, as it pursues the world’s first commercially useful, fault-tolerant quantum computers. How long the AI boom lasts is still up in the air, but if quantum can reach its potential, it could end up being the next boom area in CVC.