While AI is increasing demands on energy supply, a number of startups are harnessing AI to make energy networks more efficient and sustainable. Here are ones to watch.

AI is the cause of a crisis facing the energy sector — but could also hold part of the answer to solving it.

“There is a mismatch between the expectation of the technology sector on one side and the energy sector on the other,” said Siddarth Singh, who works in the office of the chief energy economist at the International Energy Agency, in a webinar hosted by GCV’s Global Energy Council.

AI has created a rapidly-expanding need for data centres and compute power. There are now more than 11,000 data centres around the world, and many more in construction or planning, putting a particular strain on grid systems, says Singh, particularly as they tend to cluster around each other and around urban centres, unlike other large industrial power consumers.

They are also getting larger. Today, a hyperscaler data centre for AI could consume as much electricity as 100k households. The largest ones being built today could eventually consume up to 2 million households. If data centres cannot be powered with sustainable energy sources, says Singh, they will become the second-largest source of carbon emissions growth by 2035.

Potential AI solutions?

AI could, however, offer some solutions in making electricity grids work more efficiently. One of the main challenges of the energy grid is maintaining a constant balance between the energy being generated – ideally renewables or baseload nuclear – and the energy being consumed. If all the industrial use cases of existing AI technology could be scaled up, we could save the same amount of energy per year as Mexico uses.

Lisbeth Kaufman, head of climate tech startups at AWS, thinks of the relationship between AI and energy as a flywheel, with each able to help each other. AWS is working with a number of novel energy technologies like fusion, where AI is currently playing a big role in finding breakthroughs, which will hopefully, in turn, help AI grow on the other side.

A number of startups working on the intersection of AI and energy presented their solutions as part of the webinar hosted by the GCV Global Energy Council.

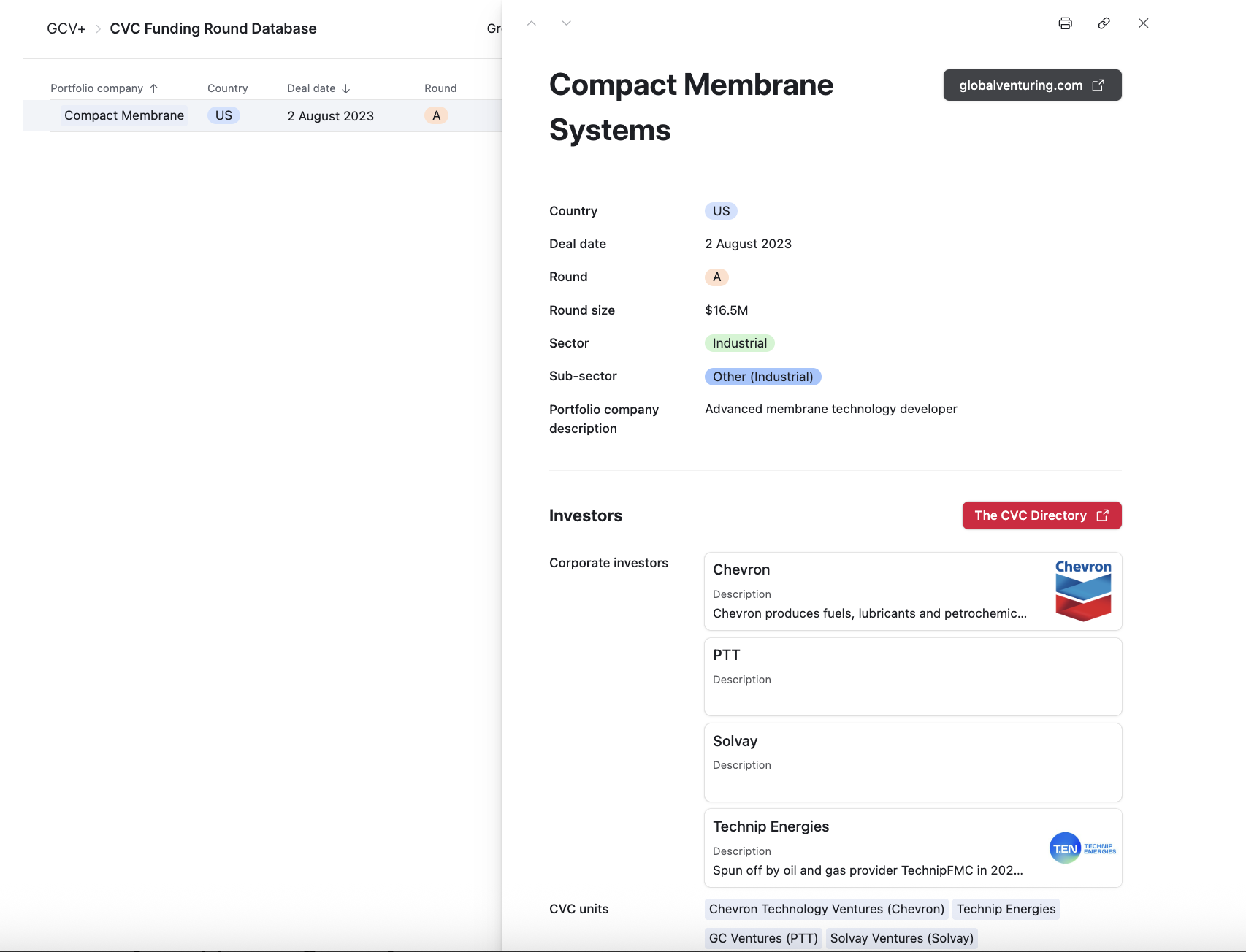

Ardent Technologies

- Founded: 1993

- HQ: New Castle, Delaware

- Funding to date: $16.5m

Ardent Technologies (formerly known as Compact Membrane Systems) is a US-based startup working on developing membranes for point source carbon capture, everywhere from smaller appliances to industrial sites.

It uses a modular unit design in which a low-energy, cost-effective membrane separates the CO2 from other particles, in a way that ultimately brings down CAPEX and OPEX relative to alternative methods.

The startup currently has pilots in a number of sectors, including steel, cement, and petrochemicals.

Beyond Limits

- Founded: 2014

- HQ: Glendale, California, US

- Funding to date: $133m

Beyond Limits is a California-based company that uses what it calls hybrid agentic AI to optimise and increase the performance of autonomous systems. The startup focuses primarily on four areas – global supply chain, product optimisation and reliability, enterprise LLM and agentic AI, and security, safety and inspection.

It is a no-code platform that allows people to automate their core processes in a dynamic way. It brings in structured and unstructured data to build out AI workflows that let companies have holistic views over their entire operation, giving autonomous intelligence at a large scale.

It is trying to solve for problems that have resulted in some 80% of industrial enterprise AI projects never making it past pilot stage because of security and value concerns.

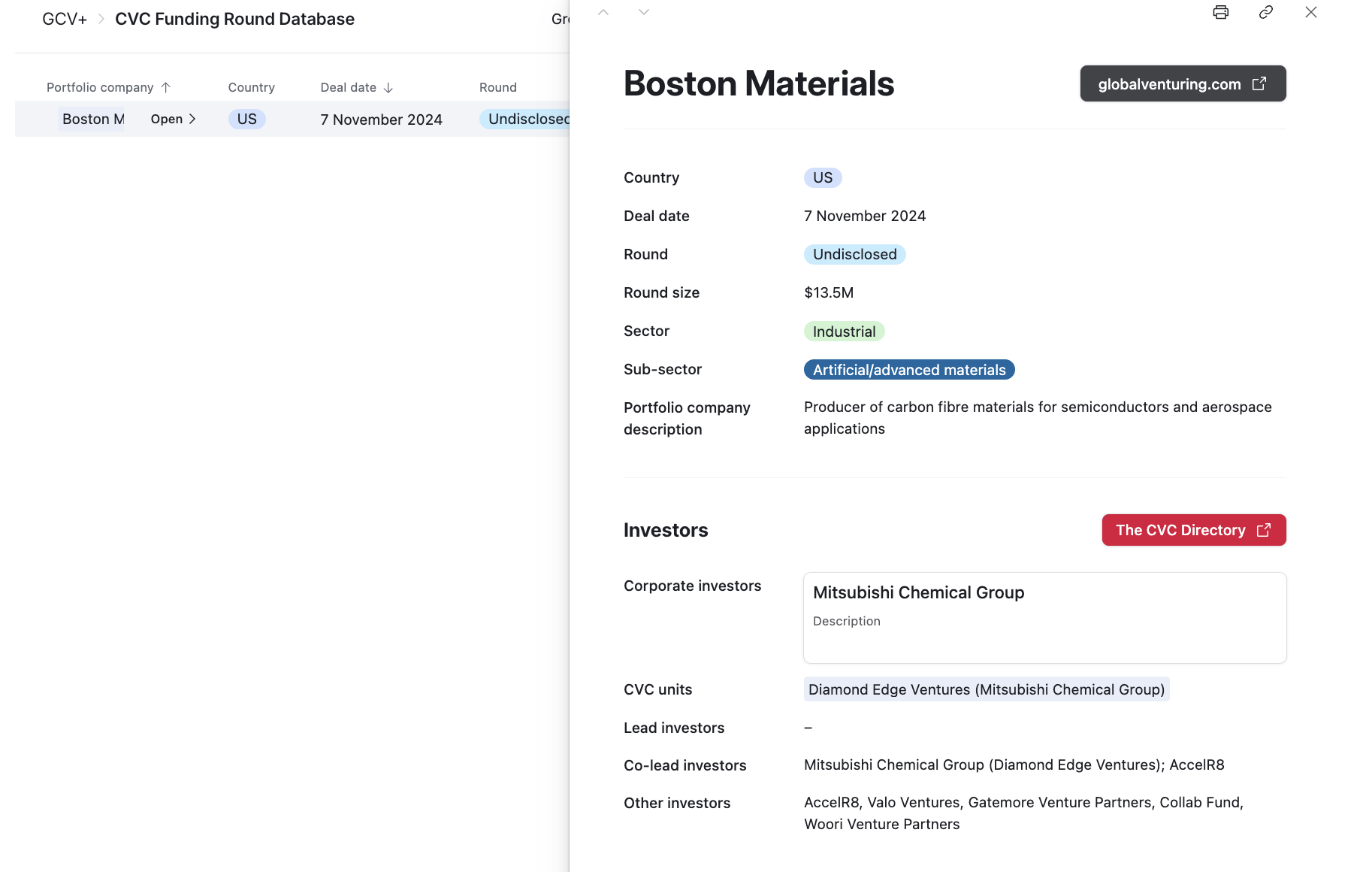

Boston Materials

- Founded: 2016

- HQ: Billerica, Massachusetts, US

- Funding to date: $43.2m

Data centres need a lot of power, and the chips waste a lot of that power to heat. Historically they have been air cooled, and more recently they’ve been liquid cooled.

Now, startups like Massachussetts-based Boston Materials are looking at direct-on-chip cooling systems. Through new composites like their sponge-like Z-axis Fiber, they can provide very low thermal resistance to provide more heat transfer along surfaces that get warped with heat, their sponge-like materials do just that.

What it’s resulted in is temperature-drops of between 4-10 degrees Celsius, which, of course also have financial implications in terms of energy efficiency and hardware durability.

Climetric

- Founded: 2024

- HQ:

- Funding to date: N/A

Climetric is looking to optimise the way building use their HVAC systems, which today typically waste up to 30% of their energy, in a market that is projected to hit nearly $300bn by 2028.

With the use of edge AI, the company is looking to reduce 30% of HVAC energy consumption autonomously, predictively, and without depending on the cloud. Their subscription platform is based on building size and other factors.

It is also designed to better protect against cyberthreats and security breaches, with exclusive access to SRI’s edge AI stack.

Gridcare

- Founded: 2024

- HQ: Redwood City, California, US

- Funding to date: $13.5m

The problem of grid capacity is central to the problem of powering data centres, and getting connection to the grid is one of the biggest bottlenecks to building new data centres. California-based Gridcare is looking to tap into what they say is circa 60% of unutilised grid capacity.

Unlocking power from the existing grid, the company says, is by far the quickest and most cost-efficient way to power more data centres. Even a 10% improvement in grid usage could translate to over 100GW of capacity.

Gridcare’s platform can look at the grid and identify where the constraints are, the probability of those constraints occurring, and how to mitigate them. It physically maps out where the latent capacity is sitting.

It can, ideally, transform how data centres are sited, choosing places where there is hidden power, rather than trying to connect power to pre-existing sites.

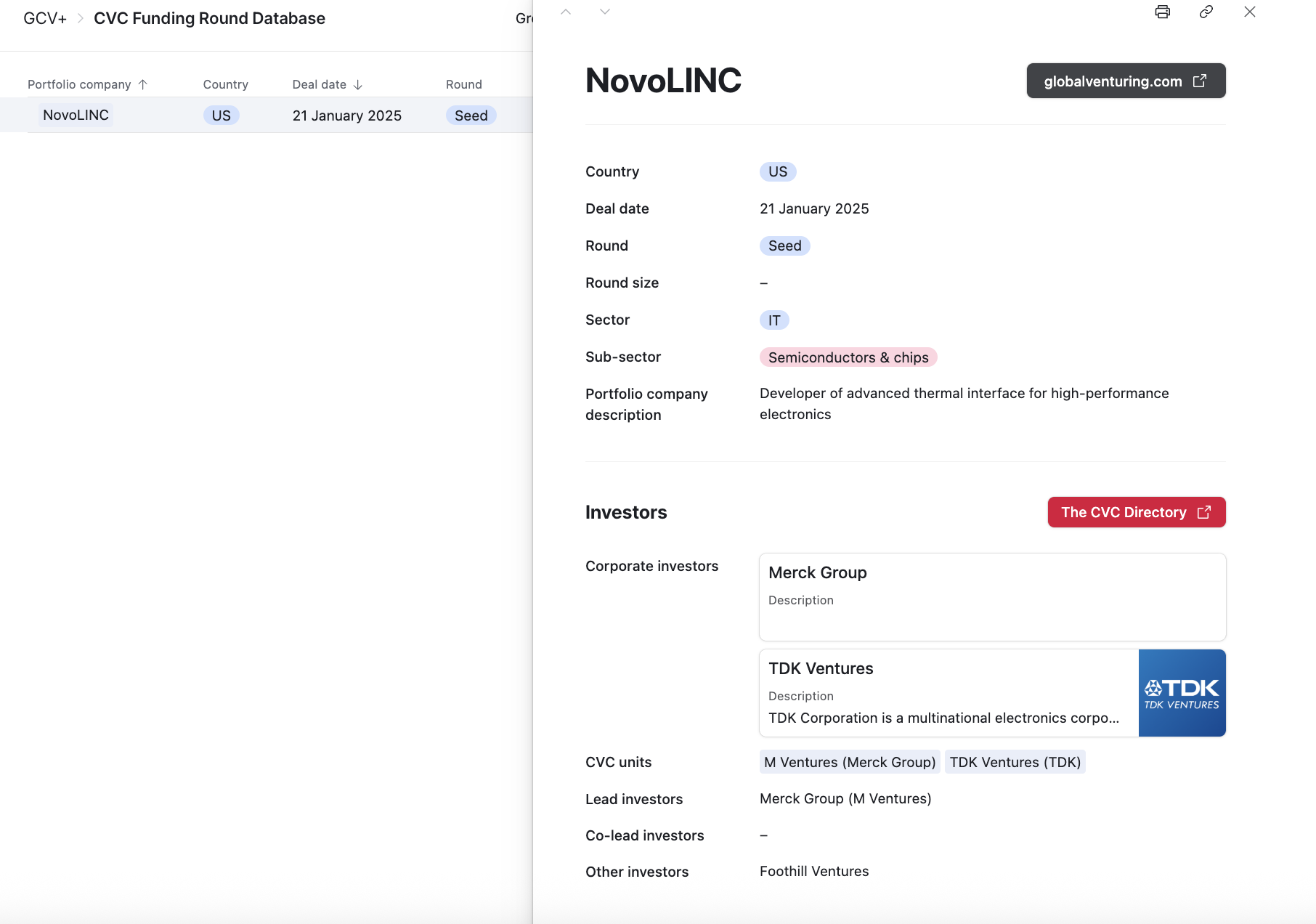

NovoLinc

- Founded: 2024

- HQ: Pittsburgh, Pennsylvania, US

- Funding to date: Undisclosed amount in seed round

NovoLinc, a US-based startup, is looking to abate the 30-40% of data centre energy that gets wasted through cooling.

They are developing the interface between direct-to-chip liquid cooling cold plates and the CPUS or GPUs. Their nanostructured composite, according to the company, is 2-3x better in terms of thermal resistance than solder, which is the industry gold standard.

It is also flexible enough to move around with the heat-warped chips, allowing for constant contact with both the chip and the cooling plate. Overall, they say it can lead to a more than 30% efficiency gain in the cooling system.

It counts corporate venturing units like M Ventures and TDK Ventures as investors.

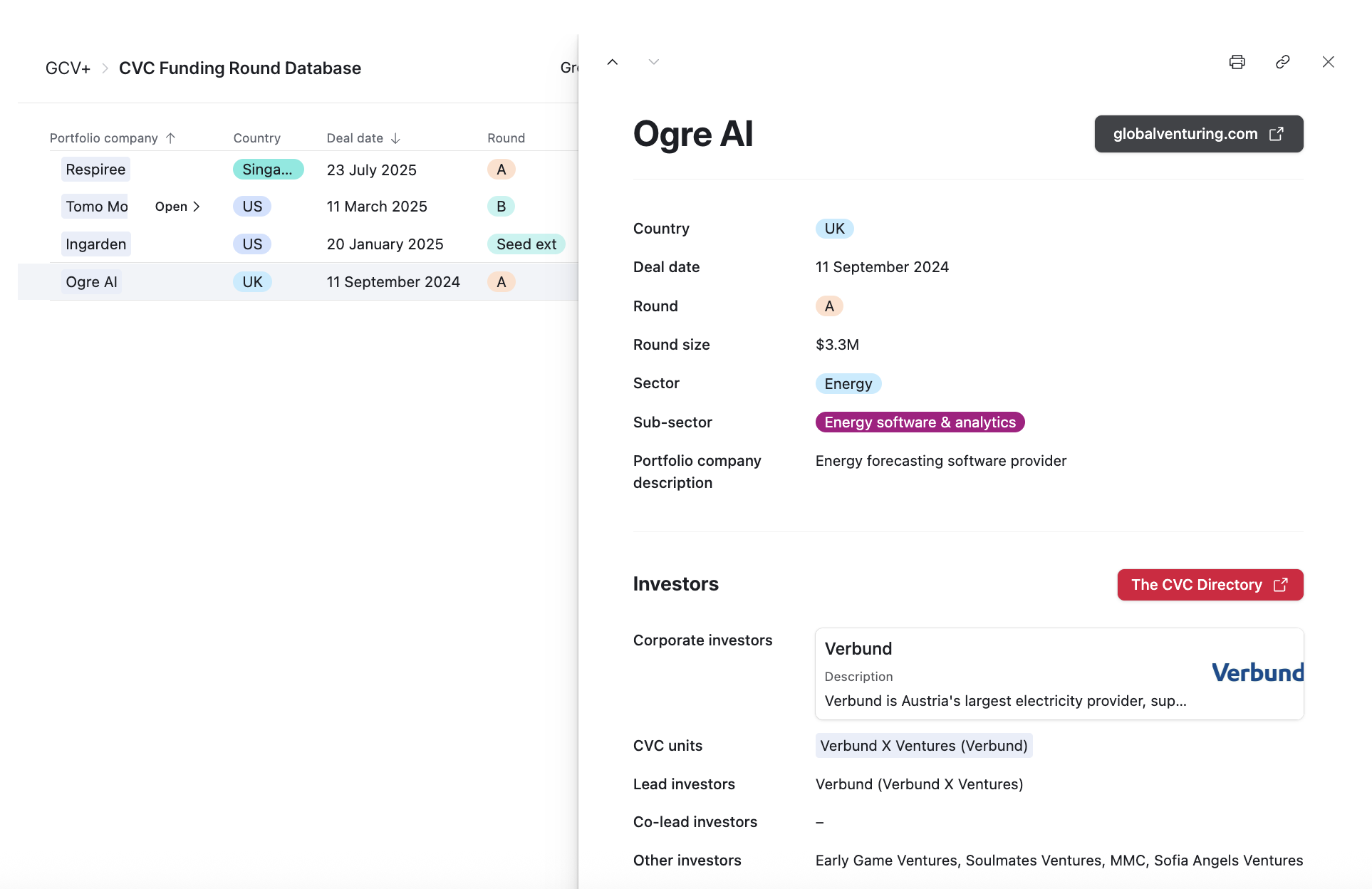

Ogre

- Founded: 2021

- HQ: Bucharest, Romania

Funding to date: $6.25m

Bucharest and London-based Ogre is a startup focused on providing AI-power energy forecasting and optimisation services.

Its platform generates forecasts for power generation, demand, prosumers, technical losses, EV charging and anomalies, in order to maximise the ability to balance the grid across the entire energy value chain.

It’s currently active across 13 countries, working primarily with utilities and energy system operators. It hopes to raise a series A round in Q2 2026.

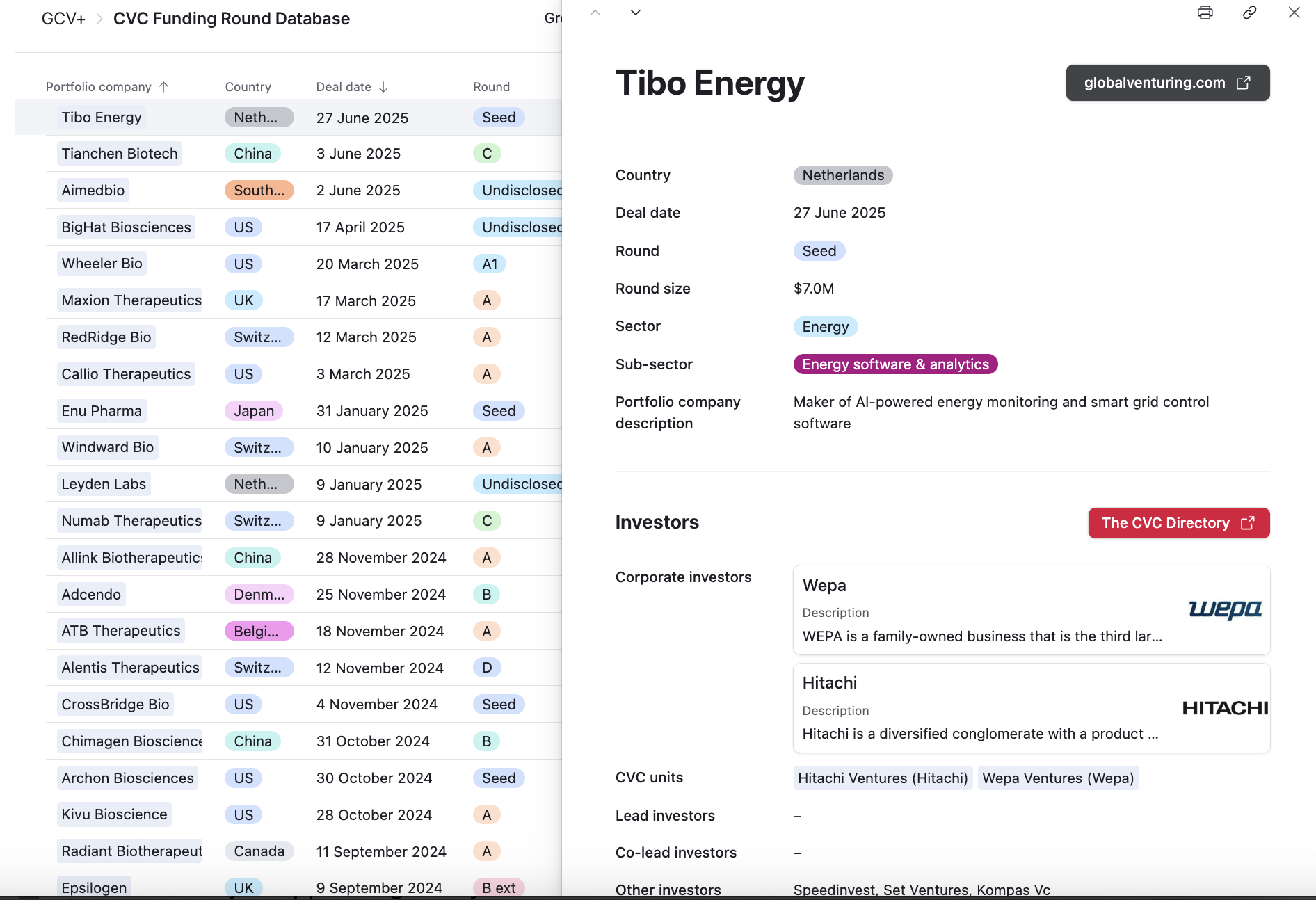

Tibo Energy

- Founded: 2022

- HQ: Eindhoven, Netherlands

- Funding to date: $10.26m

Netherlands-based Tibo Energy is an AI-powered energy management platform provider that aims to mitigate the problem of grid congestion by making decentralised energy systems easier to manage.

The platform, which focuses primarily on high energy-use facilities rather than residential spaces, forecasts supply and demand, as well as how to optimise the use of energy storage.

It envisions that by the end of the decade, AI will render decentralised systems able to make the energy landscape look like a nervous system, with energy management systems communicating with each other.

Barriers to adoption

To make a difference, these startups will have to overcome a number of challenges.

At the policy level, says Singh, there are too few incentives across global jurisdictions for commercial buildings, for example, to be digitised to such a level that AI can be used to optimise them in the first place. Buildings, which make up a huge chunk of the world’s carbon emissions, need to be digitised at scale for AI to have any effect.

Elsewhere, data availability is also a problem, with utilities not knowing enough about energy use at the household level in many cases to know when use is peaking such that they can be abated.

A relative lack of AI talent is also a bottleneck.

“We see that even in startups, who are super innovative and cutting edge,” says Kaufman. “Often, the technical teams at deeptech companies come from academia. They’re experts in their specific fields of science and engineering, but they might not as up to speed on AI. So sometimes they don’t necessarily understand, or are just not aware, of the benefit that AI can offer to help speed up what they’re building.”

Watch the full discussion and startup presentations:

This article was produced in collaboration with GCV’s Global Energy Council. Find out more here about the Council’s recent projects and upcoming programme.