Paypal participated in a $58m round for buy now, pay later service Tabby while Toyota backed carbon-absorbing tree developer Living Carbon’s $21m series A.

M&A

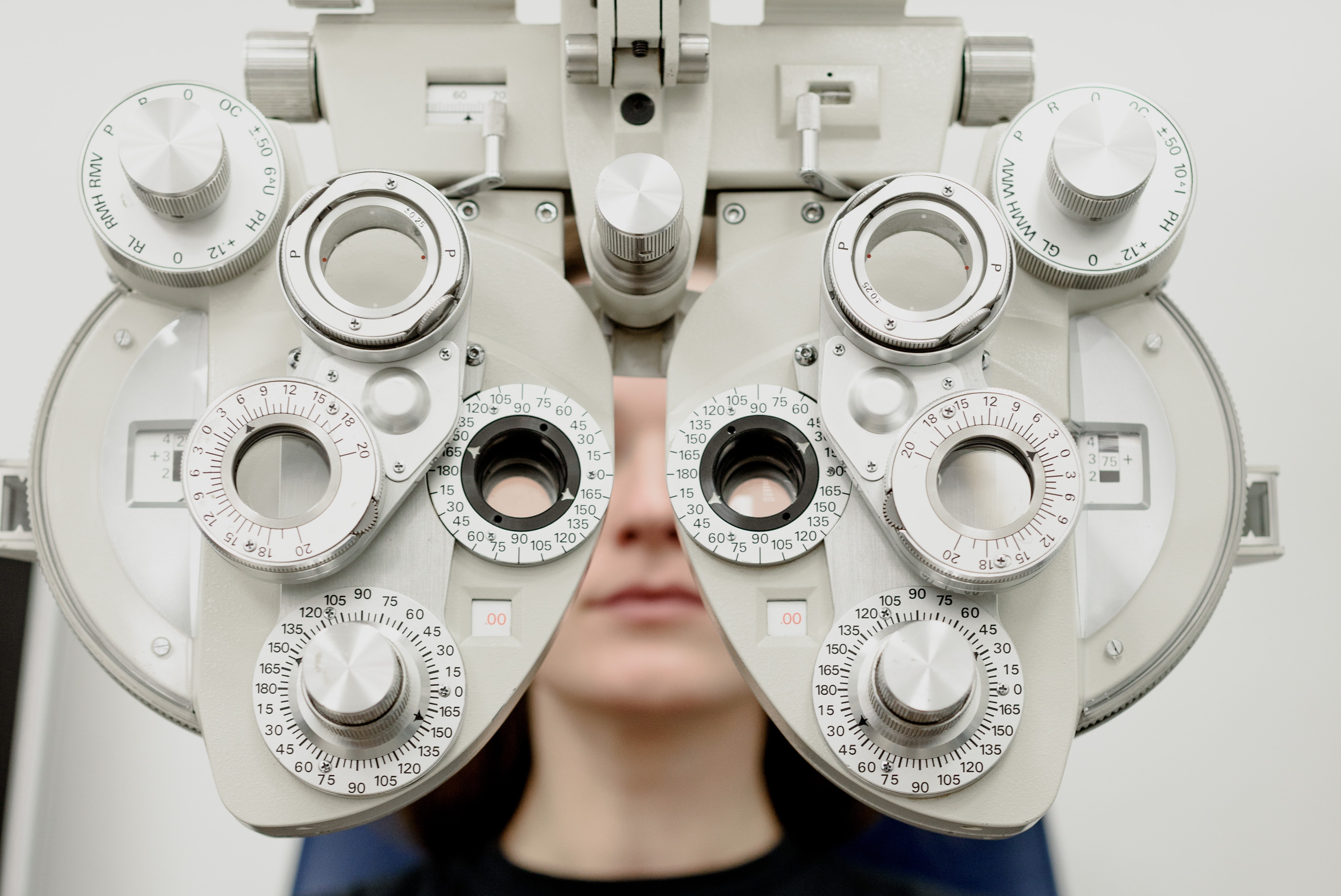

An unnamed affiliate of eyecare technology provider Bausch & Lomb has acquired portfolio company AcuFocus, a US-based developer of near vision treatment equipment, in a deal of undisclosed size. AcuFocus had raised over $215m as of a 2016 series D round, from investors including medical device producer Medtronic, before adding $24m in 2018 according to a securities filing.

Internet-of-things services software producer Trackunit has paid an undisclosed sum to buy Flexcavo, a Germany-based provider of construction equipment rental software, enabling machinery manufacturer Wacker Neuson to exit.

Cryptocurrency-focused accounting service TaxBit has purchased Tactic, US-headquartered peer that counts finance automation software provider Ramp and cryptocurrency exchanges FTX and Coinbase as investors, for an undisclosed amount. All three participated in an $11m round in September 2022 that took the total raised by Tactic to $13.6m.

Funding

| Company | Company description | Sector | Country | Round | Round size($m) | Deal date | Investors |

|---|---|---|---|---|---|---|---|

| Tabby | Buy now, pay later platform developer | Financial | UAE | N/A | 58 | 18/01/2023 | Paypal (Paypal Ventures), Saudi Telecom (STV); Sequoia Capital (Sequoia Capital India)(lead), Mubadala Investment Capital, Arbor Ventures, Endeavor (Endeavor Catalyst) |

| Living Carbon | Genetically engineered carbon-absorbing tree developer | Energy and Natural Resources | US | A | 21 | 17/01/2023 | Toyota (Toyota Ventures); Temasek (lead), Lowercarbon Capital, Felicis Ventures |

| PeopleFund | Online lending marketplace | Financial | South Korea | C | 20 (updated) | 18/01/2023 | Kakao (Kakao Investment); Bain Capital (lead), Access Ventures, D3 Jubilee Partners, 500 Global, TBT Partners, IBX Partners, CLSA (CLSA Capital Partners Lending Ark Asia) |

| Forum Mobility | Zero-emission trucking depot builder | Services | US | A | 15 | 17/01/2023 | Edison International, Amazon (Climate Pledge Fund); Homecoming Capital, Obvious Ventures, Overture, Elemental Excelerator, CBRE Group (CBRE Investment Management) |

| Obol Labs | Distributed validator technology developer | IT | US | A | 12.5 | 17/01/2023 | IEX Group, Coinbase (Coinbase Ventures); Pantera Capital (co-lead), Archetype (co-lead), BlockTower, Nascent, Placeholder, Spartan, Ethereal Ventures |

| Intella X | Web3 gaming subsidiary of entertainment group Neowiz | Media | South Korea | N/A | 12 | 17/01/2023 | Polygon, Animoca Brands, XL Games, Wemix, Planetarium, Pearl Abyss (Pearl Abyss Capital), Magic Eden, JoyCity, Global Coin Research; Big Brain Holdings, Crit Ventures, unnamed others |

| Syky | Digital fashion platform | Consumer | US | A | 9.5 | 17/01/2023 | Polygon (Polygon Ventures); Seven Seven Six (lead), Brevan Howard (Brevan Howard Digital), Leadout Capital, First Light Capital |

| Sprinque | B2B payment software developer | Financial | Netherlands | Seed | 6.5 | 16/01/2023 | Creative Artists Agency/NEA (Connect Ventures) (lead), Kraken (Kraken Ventures); Inference Partners, Antler, Volta Ventures, Force Over Mass, SeedX |

| Chara Technologies | Light commercial vehicle motor developer | Transport | India | Pre-A | 4.8 | 17/01/2023 | Bitexco (Big Capital), Log9 Materials; Exfinity Venture Partners (lead), Kalaari Capital, Cite.Co |

| Doorkel | Developer of school management platform SchooLynk Contact | Services | Japan | Pre-A | 2.3 | 18/01/2023 | Nippon Life (Nissay Capital) (lead); Ikemori Venture Support; unnamed debt suppliers |

| Elixir | Cryptocurrency protocol operator | Financial | US | Seed | 2.1 | 17/01/2023 | Quantstamp, KuCoin, FalconX, Blizzard (Avalanche VC), Gate.io; Commonwealth, Arthur Hayes, Chapter One Ventures, Betaworks, OP Crypto, unnamed others |

| Darwinbox | Human resources software provider | Services | Singapore | N/A | N/A | 17/01/2023 | Microsoft |