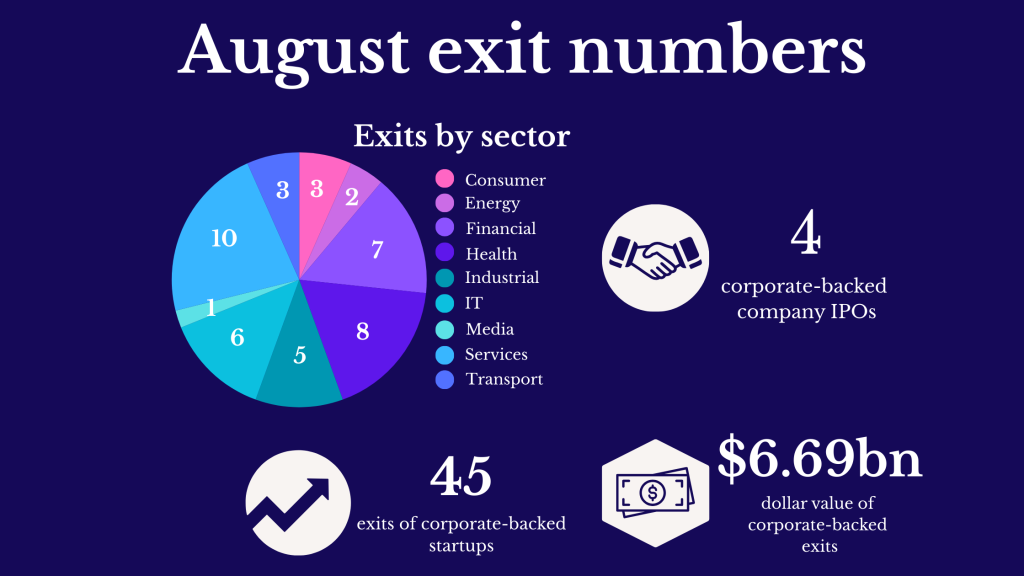

The fact that August saw the lowest number of exits so far this year – yet more than almost every month in 2024, bodes well for investors.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.