The stability and strategic partnering power of corporate investors comes into its own in a downturn. But CVCs must make sure they are ready.

The global venture capital market is still finding its new balance after the downturn driven by several external shocks such as inflation, interest hikes, supply chain issues, recession signals, the war in the Ukraine as well as the energy crisis, just to name a few.

Similarly to public stocks and the overall venture capital market, corporate venture capital is experiencing a decline in funding versus an all-time high in 2021, when CVC funding globally reached $177.1bn. In Q3 2022 global CVC-backed funding decreased by 34% quarter on quarter from $28.0bn to $18.6bn. While the funding amount decreased, the projected number of CVC deals for 2022 is currently expected to reach the level of 2021 – while Q3 also showed a decline of 14%, the global number of CVC deals in 2022 might even be hitting a new all-time high. (Source: CB Insights, State of CVC Global Q3 2022 as well Global Corporate Venturing).

CVC currently contributes a relatively small portion to the overall funding of startups, accounting for 8% of total venture funding in 2022 to date.

But the (relative) size and importance of corporate venture capital in funding and startups will increase for four reasons:

1. Focus has shifted to profitability

Corporate venture capital adds a very important ingredient beside capital. Of course, capital is a crucial ingredient, in particular in times like these when the tide is turning and the extension of runway is critical. However, CVCs can differentiate themselves and add further value by giving access to further clients and/ or revenue opportunities. With stronger focus not only on growth, but also profitability, the own CVC’s corporate and its network become an even greater enabler for startups’ access to potential clients and revenues.

There are two ways CVCs can contribute clients & revenues to the startup, in (a) a direct and (b) an indirect way:

(a) The direct contribution is rather obvious, turning most corporates into a paying client of the startup. In my experience, particularly for earlier stage startups (+/- Series A), such a major anchor-client is very important for future development. In practice, I have seen “land & expand models” work very well in larger organizations: landing a contract in one part of the CVC’s corporation (e.g. a business unit or region) or with one part of the startup’s solution, going through the procurement process for this specific contract and expanding from there within the corporation. Leveraging the initial sponsor plus CVC team as an ambassador helps in opening many doors within the corporation.

(b) The indirect contribution may often be the even larger contributor to growth and profitability. Through the adoption of a solution by a large trusted corporation, the startup is already benefiting by receiving a “trust stamp”. This improved credibility can have a leverage effect for new pitches (as a startup, try to ensure to get the permission to communicate the corporate as a client, being a portfolio company helps here a lot as it’s often public). Moreover, value-added CVCs actively offer corporate know-how, provide access to assets/resources and introduce connections & potential new clients to the portfolio company (and yes, having competitors using the startup’s solution is a positive outcome, in particular for platform, infrastructure and network solutions).

Here is some homework for CVCs: It is critical for a value-added CVC to have a dedicated business development team focusing on promoting the portfolio company internally (within your own corporate environment) and externally. A “magic” portion of the team focusing on business development I often see is 1/3 of the entire CVC team.

2. Due diligence is “back”

2021 was an exceptional VC year for many reasons. One of them was the lack of time for due diligence or, to put it differently, the “time to invest”. In many conversations with VCs, partners told me how much even they sometimes struggled to go through due diligence within days of analysing the startup and convincing the founder that they are the right investor. It was more fear-of-missing-out and focus to join the financing round than actually assessing if it’s the strong company/product/market. For a CVC, 2021 was even tougher as there are certain due diligence requirements that corporations have to follow and a due diligence within days just not feasible.

“Making investment decisions within a few days of meeting founders is not healthy.”

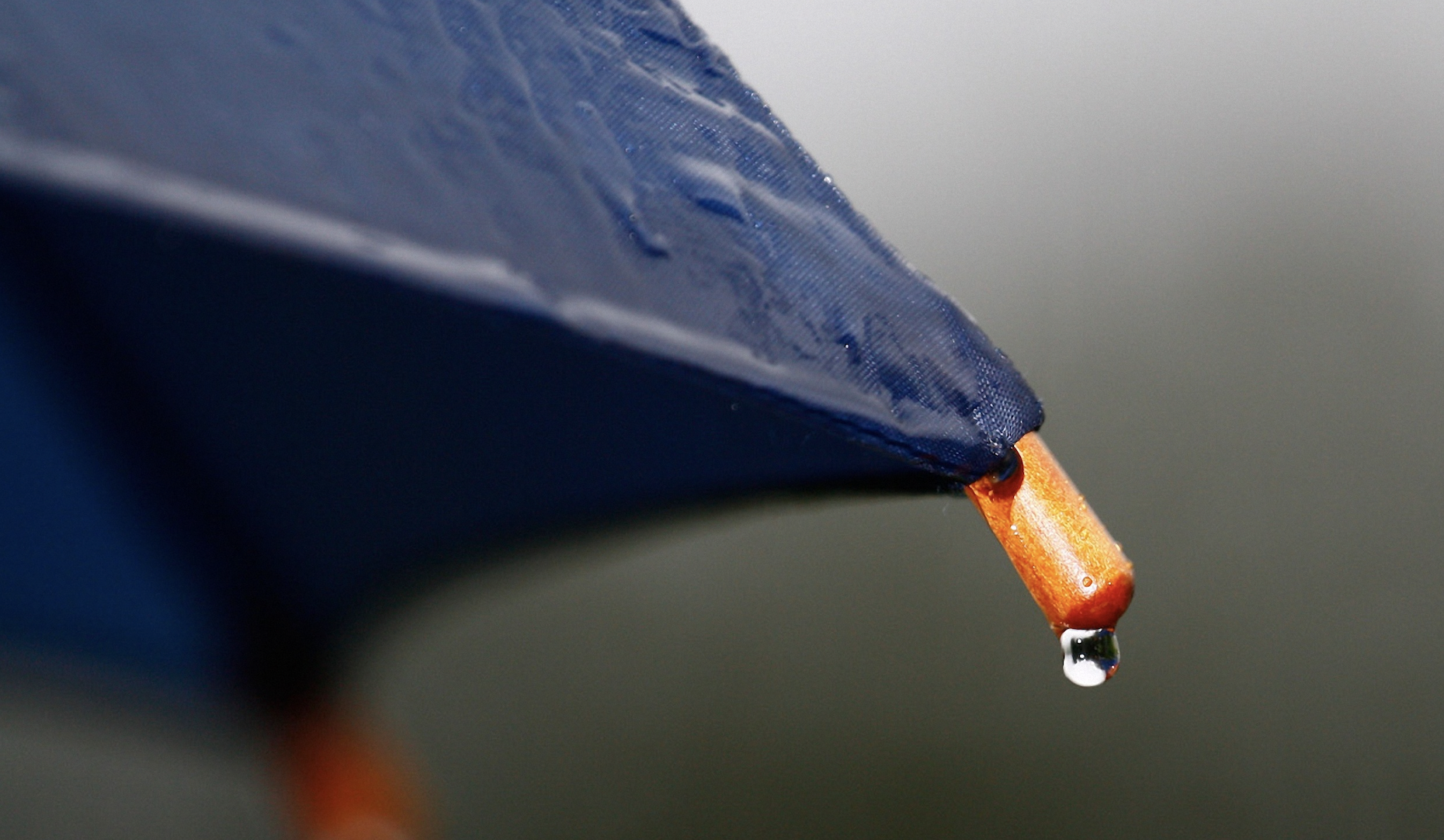

The new (and previous) normal of due diligence is back. I know for some founders this might sound like bad news. From my perspective, though, it isn’t. It ensures that capital is going into the right companies. Making investment decisions within a few days of meeting founders, team, company, product/ tech and financials is not healthy and leads to wrong capital deployment. As Warren Buffet says, “only when the tide goes out, do you discover who’s been swimming naked”. Closing a funding round with normal levels of due diligence, helps to identify potential challenges early and address them and thus reduce the risk of startups swimming naked when tides go out. For an economy, efficient and right capital deployment is critical too.

Here is the second part of the CVC homework. From my experience, three things are critical for CVCs:

(i) An agile investment governance process: Having the ability to take a decision within days after completing due diligence is crucial. A lean investment process, which fits to your organisation is key.

(ii) Transparency with the startup regarding the due diligence and decision process from day one.

(iii) Efficient due diligence processes appropriate for the respective investment type (a minority early stage CVC investment does not require the same due diligence as an acquisition of a major company).

3. Strategic focus brings stability

CVCs usually have a strategic and financial focus. The focus of CVC and its corporation lies on the growth and profitability of the startup, plus the product of the startup. As a client of the startup, the focus on the actual product is critical for the startup’s development and the role of the CVC.

The additional focus on the product provides the startup with further aligned interest. In particular during times when the tide goes out, having an investor which is focused on your product adds stability. I have experienced several cases, where in particular CVCs added fresh capital e.g. to build out the startup’s product roadmap or extend the runway in challenging times. CVCs are often measured not purely on financial return of the investment, but also on strategic KPIs (such as the number of product deployments, impact/return from using the product and the number of cross-selling opportunities). This provides a startup a more diversified investor base and stability.

Moreover, the CVC can provide additional advice and perspective to the startup strategy. I observe the CVC often taking the “client” role in Board discussions (voting or non-voting). It is a very valuable and healthy perspective in Board discussions, hearing pain-points of clients and product opportunities in addition to the pure investor perspective.

For the third CVC homework a few points to be a stable investor:

- (i) Having pre-emptive rights to join the next round is a right but also a responsibility. While there are often good (or not so good) reasons why not to join the follow-on round, from my perspective it is particularly important to join the round following your initial investment. It demonstrates a strong signal to the market and further demonstrates stability in the investor base. I am aware that CVCs/ investors cannot always follow-on even if the investment is strategically and financially on track. However, I would argue to include the “signal to market” into your assessment of your follow-on decision as a strategic investor, in addition to financial arguments to double-down on your winners.

- (ii) Consider who from the corporation is the best fit for joining the startup’s Board – putting the ego aside, the criteria should include subject-matter-expertise, diversity, network, startup understanding, time and joy as well as potential areas which the startup’s Board is currently lacking, to name a few.

- (iii) Keep capital reserves for at least one follow-on round. As many CVCs are investing from their balance sheet, it is often more a pre-alignment than actually having reserves in your fund.

4. CVC spending has an increased impact

There is the saying, that “every dollar/euro a corporation spends on innovation counts double during recession”. For a CVC, I would argue that it counts even triple.

I am a firm believer that corporations can make a significant impact on the future growth trajectory of the firm during a downturn or recession. The triple value comes from the investment itself, from innovation that CVC portfolio startups bring to the corporation, and from how partnership further creates value for the startup (kingmaker), in particular in an environment with softer valuations.

Every dollar a corporation spends on innovation counts double during recession. For a CVC it counts triple.

Corporate venture capital can be a strong catalyst for open innovation for corporations from various angles. Through the scouting activities, CVC teams usually discover new innovation trends early. This holds true in particular if the team is also scouting in the pre-series A environment. Connecting those gained insights back to business leaders is an important source for making right and future-focused corporate strategy decisions. Strategically investing in startups offers the corporate direct access to innovation. Benefiting from external innovation and adopting such solutions allows corporations to tap into a pool of innovation, which is often not possible internally. An investment often puts the focus on a partnership with the startup and provides a push for the adoption/landing and expansion. Strategic partnerships with equity participation offer corporations a front seat in the startup (plus often Board representation) and at the forefront of innovation in that area. It can help in achieving your corporate strategy, expanding your product offering and skills, hedging your strategy or leap-frogging in previously under-invested areas.

Venture capital itself offers attractive returns. The current environment of softer valuations and a “flight to quality” has further increased the returns for high quality startups. Signing vendor agreements between startups and the corporate will often already increase the enterprise value / total equity value, especially when the startup is early in its phase and the contract is one of the first enterprise agreements. Here, the corporate acts as a “kingmaker” and can additionally benefit on the equity value side, when the investment is done prior to or in parallel to the vendor agreement signing.

Fourth and final CVC homework:

- (i) Keep the corporate’s commitment to innovation and keep the commitment to the CVC or maybe even double-down. As part of such a commitment, prioritising your innovation and investment portfolio, diversification (investment strategy) as well as teamwork (Business Development) are key.

- (ii) A well-established link of the CVC arm into various business and infrastructure units is required to make right strategic investments and maximize return. From my experience, it starts from aligning the investment trends – a healthy balance between the CVC’s own investment themes and investment themes from the business units is ideal. Moreover, involving business units and subject-matter-experts in the discovery & due diligence process helps with making the right financial and strategic investment decisions. Finally, allowing landing & expanding of solutions in corporations requires a strong link between the CVC business development unit and different areas of the corporation.

Conclusion:

A downturn is the perfect time for value-added CVC to show its strengths. So, if you are a startup planning your next funding round, connect with CV. If you are an investment professional looking for the next career opportunity think about CVC. And if you are a corporate planning your strategy and budgeting process — connect with CVC.

Joerg Landsch is the head of corporate venture capital at Deutsche Bank.