From emerging brands to retailers and technology developers, these 10 startups are bringing non-alcoholic beverages into the mainstream.

A decade ago, the non-alcoholic beverage industry barely existed, or if it did, it was largely restricted to fruit juices and fizzy drinks. But a wave of startups have used new techniques, often combined with savvy marketing, to make their presence felt and have lifted the sector into the consumer mainstream.

Here are 10 of them, ranging from a non-alcoholic French sparkling wine brand and a drink influenced by hallucinogens, to a molecular alcohol removal developer and a curated ecommerce platform for non-alcholic drinks.

Sèchey

Charleston, USA

Founded: 2021

Funding to date: Undisclosed

Sèchey runs a curated ecommerce platform for premium non-alcoholic drinks, including functional and THC-infused beverages.

It’s a tricky area – New York-based peer Boisson declared bankruptcy last year after raising nearly $35m – but Sèchey has expanded into releasing its own drinks, and its wine is carried by big-box retail chain Target in its own section.

The company, which takes its name from the French word for ‘dry’, has not revealed details of how much it has raised, but it received an undisclosed amount of funding from beverage-focused private equity firm InvestBev almost a year ago.

De Soi

Los Angeles, USA

Founded: 2022

Funding to date: $4m

Some of the most successful alcohol brand startups in recent years have been launched by celebrity co-founders, be it Ryan Reynolds’ Aviation Gin, Dwayne Johnson’s Teremana Tequila or David Beckham’s Haig Whiskey. Pop star Katy Perry (pictured right) is targeting the non-alcoholic market as co-founder of De Soi.

De Soi produces a selection of canned non-alcoholic apéritifs made with natural adaptogens – plant extracts capable of helping the body tackle stress, anxiety or fatigue – and boasts that its drinks taste like ‘real’ cocktails.

Consumer VC firm Willow Growth Partners led De Soi’s $4m seed round in 2022, investing alongside talent and entertainment agency CAA. Its other backers include European investment community IClub.

Thrive

Ghent, Belgium

Founded: 2021

Funding to date: $6.9m

Ever heard of a sports beer? Or a beer developed at a university instead of a brewery? Belgium’s Thrive is a genuine anomaly, especially in a country famous for its fruit beers.

The startup developed its beverages at a beer research hub formed by the University of Leuven and the Flemish Institute for Biotechnology, and it offers protein and vitamin-packed varieties of its sports beer as well as a magnesium-heavy IPA meant to help you relax, none of which contain any alcohol.

Thrive revealed a $1.1m investment by the Swerts family, owners of adhesives manufacturer Soudal, in 2023, coming after undisclosed amounts of financing from private equity firm PMV and banking and insurance firm Belfius.

French Bloom

Paris, France

Founded: 2020

Funding to date: $12m+

If Belgium takes its beer as a matter of national honour, try talking to France about its wine. But a startup called French Bloom is producing a sparkling wine made from dealcoholised organic Chardonnay, from grapes grown in the south of France.

The company, which is based in France, spent some two years on research and development prior to launching its products, which are available in more than 30 countries. Its Cuvée 2022 vintage sells for over $100 a bottle.

Moët Hennessy, the wines and spirits branch of luxury consumer goods group LVMH, provided an undisclosed amount of funding for French Bloom late last year, following over $12m in earlier financing from investor club Frenchfounders and assorted angel investors

ISH Spirits

Copenhagen, Denmark

Founded: 2018

Funding to date: $6.9m

While some alcohol-free drinks startups are specialists, fine tuning a particular drink or two, ISH Spirits has gone in the other direction, with a range of drinks modelled after everything from merlot and chardonnay to gin and agave to cocktails like mojitos and daiquiris.

The company is headed by Peter Brunn, formerly CEO of several Danish baked goods and snack brands, and its beverages are available in 20 markets.

Scandinavian wine and spirits group Anora invested almost $7m in ISH in 2022 through a partnership agreement that allowed it to distribute the startup’s drinks in Norway, Sweden and Finland.

The Pathfinder

Seattle, USA

Founded: 2021

Funding to date: $7.5m

The Pathfinder uses fermented and distilled hemp roots to produce a liquid it claims has the flavour and aromatic characteristics of a spirit, and which it markets using graphics reminiscent of the ‘miracle cures’ touted by travelling salesmen once upon a time.

Pathfinder Hemp and Root can be served straight up, on the rocks, in coffee or as part of a cocktail. The startup released a canned negroni version of its drink in January, shortly after expanding into the UK market.

The company’s funding stands at approximately $7.5m as of July this year, with vodka and whiskey producer Stoli Group supplying an undisclosed amount through a strategic investment in 2023.

Rebels 0.0%

Zürich, Switzerland

Founded: 2020

Funding to date: $3.3m

The founders of Swiss startup Rebels 0.0% say they were optimistic about the first wave of alcohol-free spirits – until they tasted them. Its range of non-alcoholic drinks, which include spritzes, botanicals, bitter aperitivos and malt blends, are an attempt to add taste and complexity to the market.

Rebels 0.0% uses a double distillation method and says its drinks, which are reputedly served at establishments including Michelin-starred restaurants and five-star hotels, have won some 20 awards at specialist competitions such as the International Spirits Challenge and Class Magazine’s Bartenders’ Brand Awards.

StartAngels Network led the startup’s $1.1m seed round in 2022 and it added $2.2m in a December 2024 round featuring an unnamed strategic investor.

Psychedelic Water

Wilmington, USA

Founded: 2019

Funding to date: $4m+

While Psychedelic Water’s drinks aren’t technically psychedelic, its blends utilise kava and velvet bean plants along with green tea leaf extracts, and are intended to create a feeling of relaxation, openness and positivity.

Psychedelic Water rode an initial wave of viral popularity on the back of TikTok coverage and the endorsement of Benji and Joel Madden of pop punk band Good Charlotte, who were named co-chairmen of the startup in 2023. It may not be alcoholic, but its effects are strong enough that you are urged not to drive while drinking it.

The startup, which was founded in Canada but since relocated to the US, had collected a total of $4m in funding as of 2021, from backers including venture capital firm Clanton Capital and an assortment of angel investors.

Lucky Saint

London, UK

Founded: 2018

Funding to date: $12m

Lucky Saint isn’t reinventing the wheel but it has forged a path as a genuine alternative in the UK, where its low-calorie 0.5% lager is available on draught in more than 1,200 pubs, as well as in can and bottle form in restaurants and supermarkets.

The company has subsequently expanded its product range with an IPA and a recently launched lemon lager. It even opened its own pub (pictured right) in 2023, located in the well-heeled London neighbourhood of Marlyebone.

Lucky Saint received $12m in a series A round co-led by VC firms Beringea and JamJar Investments at the start of 2023, to tie in with the UK’s annual ‘Dry January’ trend. It was also part of the first cohort for British supermarket chain Tesco’s Accelerator Programme the following year.

ALTR

Phoenix, USA

Founded: 2020

Funding to date: $4m+

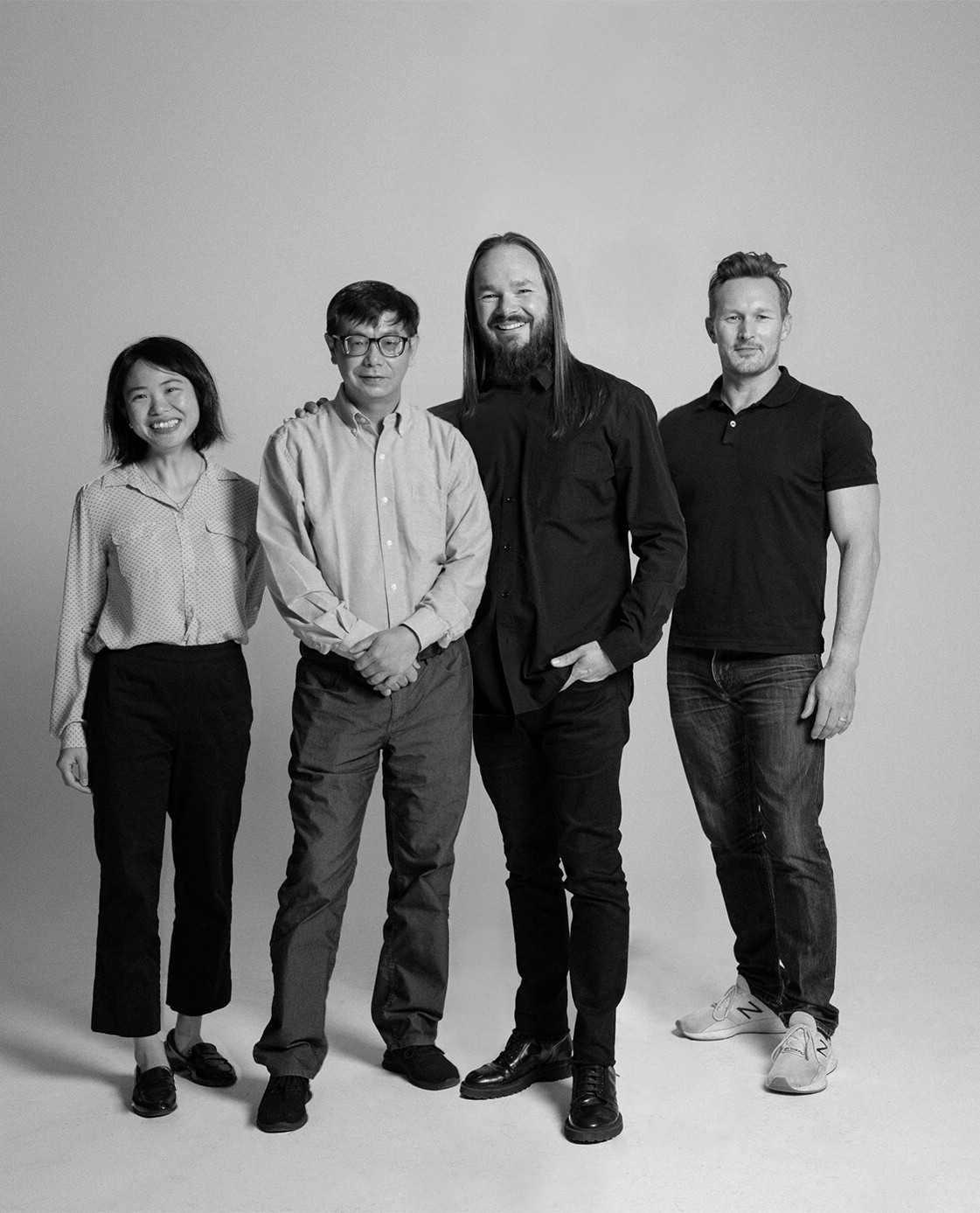

Finally, while many startups are working on getting the right blend of ingredients for their drinks, the ALTR team (pictured right) is focusing on membrane technology that can refine and improve the method of removing alcohol in the first place.

The company’s Velvet Blade alcohol separation technology allows ethanol to be removed from alcohol at a molecular level, in theory preserving the original flavour as well as its feel in the mouth.

ALTR closed its $5m seed round in July this year, securing funding from backers including Suntory Global Spirits, owner of Maker’s Mark, Old Crow and Jim Beam as well as Sipsmith gin. The cash will support the expansion of its winery partnerships.

Non-alcoholic drinks sector gets more fizz with psychedelics, probiotics

Pernod Ricard’s CVC unit focuses on investing in non-alcoholic beverage startups that address the generational shift in drinking habits.