Several corporates just helped Figure close robotics' first $1bn round, and the rapidly growing sector is attracting some of the same CVC investors as AI.

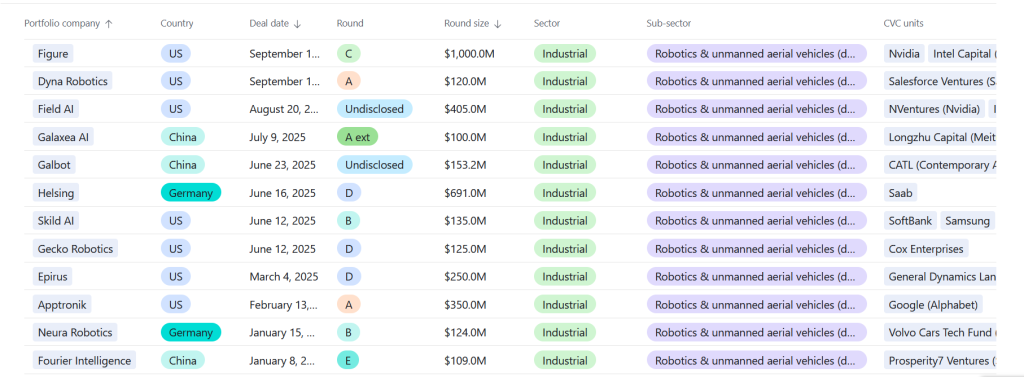

A three-year-old startup called Figure recruited half a dozen corporate investors to raise $1bn last week, in the first ever billion-dollar round for a robotics startup, a sign of how the artificial intelligence boom is now reaching the physical world.

So far, much of the AI funding has targeted software and infrastructure producers such as OpenAI, Cohere and Anthropic, and this is continuing. Just last week, AI networking company Upscale AI launched with over $100m in seed capital from investors including Qualcomm Ventures.

But Figure’s $1bn round shows that there is growing interest in combining AI with robotics. Figure is building humanoid robotics designed to tackle labour shortages, particularly in fields that are unsafe for humans, but it is developing them alongside a proprietary AI system called Helix.

The Helix platform combines perception, language understanding and learned control, enabling robots to continuously use the entire upper part of a humanoid body, including torsos, wrists and individual fingers. It also allows multiple robots to simultaneously work on the same task, and can run on chips that use relatively low amounts of power, meaning that in theory they can be used for a wide range of tasks commercially.

Chipmaker Nvidia and enterprise software producer Salesforce were among the investors in the round, which valued Figure at $39bn, as were corporate VC units Intel Capital, LG Technology Ventures, T-Mobile Ventures and Qualcomm Ventures. It was the first time T-Mobile had backed a humanoid robotics developer, but the others have all already made investments in the sector this year.

In fact, just the day before, LG Technology Ventures had been part of a $120m funding round for Dyna Robotics, together with Salesforce Ventures, Nvidia’s NVentures unit, Amazon Industrial Innovation Fund and Samsung Next. Dyna is developing a general purpose robot controlled by its own AI model.

Intel Capital and NVentures both backed AI robot developer Field AI’s $314m series A round last month, while fellow robotics technology companies Apptronik, Skild AI and Neura Robotics have all pulled in corporate investors for nine-figure rounds this year.

At the same time, in China, a raft of startups have raised big money developing offerings focused on embodied intelligence, the term for the form of AI where an AI agent interacts with the physical world.

Much like the US, where some of the biggest investors in AI robotics startups have been the corporates developing AI technology or centring their businesses around it, a good deal of the corporate funding for embodied intelligence has come from domestic companies that have bet heavily on AI themselves.

Track all the recent corporate-backed funding rounds for robotics startups in the CVC Funding Round Database

Alibaba, which recently struck a huge supply deal for its AI chips, put up $100m of the $140m raised by humanoid robot startup X Square this month, having backed a $69m round for peer LimX Dynamics earlier in the year. That LimX round was one of three embodied intelligence investments Alibaba peer JD.com announced simultaneously, while Baidu, which is engaged in AI chips as well as its own large language model, contributed to an eight-figure seed round for another robotics technology developer, OneStar Robots, just last week.

In fact, embodied intelligence and robotics seems to have been the focus for much of China’s AI investment in startups, with generative AI development generally being taken on by its tech incumbents. More than half of the companies in the ‘Humanoid 100’ list compiled by Morgan Stanley this year were based in China, and they are set to benefit from the $138 billion AI and robotics fund launched by the Chinese government in March this year.

For corporations like the ones backing Figure, robotics is a logical follow-on from AI. Industrial and manufacturing companies would benefit from AI being able to tackle physical tasks as well as knowledge work.

For chipmakers like Intel, Qualcomm and Nvidia, or software companies like Salesforce or Google – which took part in Apptronik’s $350m series A round in February – backing robotics is part of a wider bet.

If hundreds of thousands of humanoid and other robots are deployed over the coming decades, they will need chips and operating systems, creating a vast new market for the tech industry. Getting in on the ground floor now could mean getting a space in the elevator before the doors close.

CVC investors we need your help!

The corporate venture industry has never been more influential — but it is also changing rapidly. Help us track these shifts by adding in the details of your unit to our annual survey.

All responses are anonymised and we share the benchmarking data back with all respondents.