Indian drone company IdeaForge was a pioneer when it listed in 2023, but now more defence tech startups are preparing to exit as the sector's importance increases.

“The defence sector has gained a lot of momentum in recent years. As geopolitical tensions rise, old rules are being thrown out the window and new ones are being written almost on a daily basis,” says Ankit Mehta, CEO of unmanned aircraft systems maker IdeaForge.

IdeaForge was one of the first Indian defence tech startups to list on the stock exchange, having made a successful market debut in June 2023. Since then, the Indian defence sector has grown rapidly and now a number of this new crop are getting ready to list, in hopes of emulating IdeaForge’s success. Tonbo Imaging, a developer of imaging and sensor systems which counts Qualcomm among its investors, for example, is expected to file a draft prospectus soon, while drone startup Garuda Aerospace is also understood to be planning an IPO.

At the same time, India’s more established defence companies, such as Tata Advanced Systems, have been boosting internal development with Tata, for example, setting up an innovation centre in Toulouse in 2022.

India’s defence tech sector is benefiting from a number of converging trends. New types of weapons are evolving quickly. “The age-old routine of defence no longer works,” says Mehta. “You can’t just scale by buying a specific type of asset that you’re conventionally used to. You need new types of assets, which creates room for deep tech development activity to grow from the ground up and build new capabilities, new situations.”

At the same time, the need for sovereign ownership or strategic autonomy has increased due to the fractured nature of today’s world and narratives are tenuous between nations. Nations don’t want to be overly reliant on technology from other nations.

“Any capable nation who isn’t building within their geography is losing out on creating lasting partnerships and integrated solutions.”

“Every nation is on its own. The supply chain challenges, blockades, tariffs – all of these are clear indicators. In fact, any capable nation who isn’t building within their geography is losing out on creating lasting partnerships and integrated solutions. This is what is driving a lot of the investments at this point in time. As budgets get unlocked further, a lot of startups are going to see further traction,” he says.

On top of all that, recent global trade disruptions have added additional urgency.

“Tariffs and the confusion surrounding them,” says Mehta. “I think the uncertainty with this has played a role here.”

A turning point in 2020

Global defence spending has seen an unprecedented increase over the last few years, touted to be the steepest rise since the end of the Cold War, because of geopolitical tensions in Europe and the Middle East. In 2024, military expenditure hit the $2.72trn mark – a 9.4% rise from 2023 – as countries increased their defence budgets and prioritise military security in response to growing security challenges and threat perceptions.

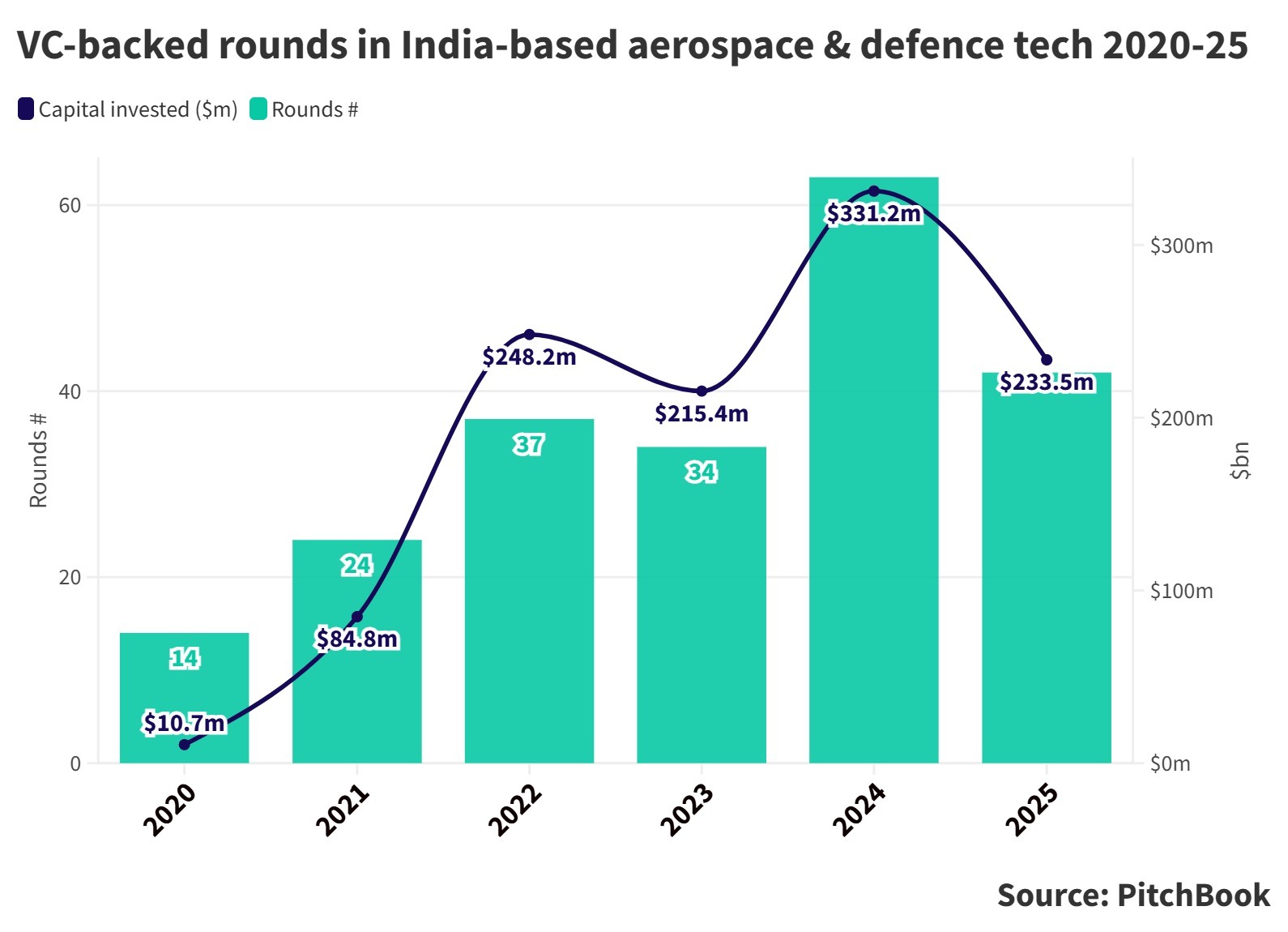

India has followed suit. Its defence budget for 2025 and 2026 stands at $78.3bn, a 9.5% increase over the previous year, aimed at modernising its armed forces and promoting domestic sourcing for procurement. At the same time, corporate-backed investment in the sector has also seen steady growth with around $233.5m already invested in 2025.

Mehta says that 2020, when Indian and Chinese troops clashed in Galwan Valley on the Sino-Indian border, was a particular turning point for the Indian defence tech sector.

“The pandemic, Galwan and then the global wars made it necessary for us to use drones to get eyes on our borders and ensure we had more awareness of our situation. This led to the early introduction of attack-type drones as well as counter drone systems in the ensuing years.”

Attack and counter drone systems have now become a priority from a national security perspective. But drones for surveillance remain critical because “you don’t attack if you don’t have systems that can pick up targets”.

“And finally, when 2020 began, resilience on the battlefield was not as big a worry since you weren’t countering counter drone systems. But this has become a protection mainstay over the course of the Russia-Ukraine war. This means resilience to electronic warfare, or jamming, has become a critical vector for drones as well as any ground assets that rely on GPS signals to work.”

India – a hub for deep tech innovation?

India’s growing defence tech sector also taps into a push by the government to build up the country’s deep tech capabilities. A few months ago, at a government-led startup conclave, India’s commerce minister Piyush Goyal urged entrepreneurs to explore more innovations in robotics and artificial intelligence to help the country progress. This sparked a debate on the country’s position when it came to deep tech innovation.

Mehta says India has the potential to be a deep tech hub but still has a way to go to achieve success. “As engineers, our ability to peel the layers has to grow. Our ability to system-integrate has to improve as a nation. We need to aim to make the world’s best products, as opposed to locally relevant products. And there needs to be a tremendous amount of capital backing the right kind of capability.”

The problem is timing, he says. There are good entrepreneurs or good technologists creating technology, but they end up getting support too late.

“I think it’s a matter of deciding to choose raw talent in technology versus deciding to choose a narrative. Narratives end up delaying the cycles because they can’t get the technology up to steam in time. At the end of the day, deep tech is unforgiving, particularly when you’re trying to create the world’s first best solutions.

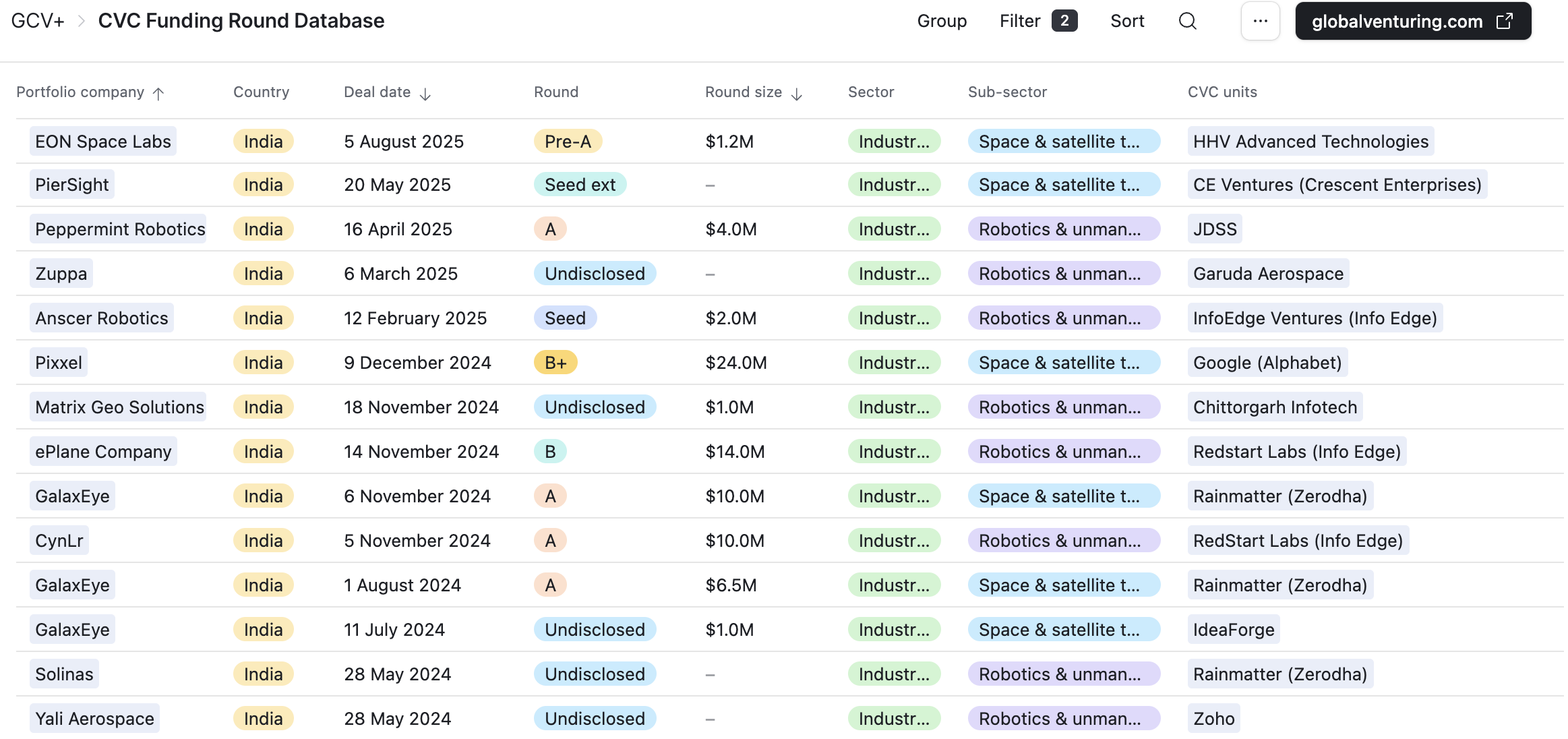

See all the recent Indian robotics and space tech startups backed by corporate investors in the CVC Funding Round Database.

A raft of IPOs might help strengthen the case for investing in deep tech, and any defence tech listings that go through will contribute to this.

But Mehta, with now two years as the CEO of a publicly listed company under his belt, says startups looking to list should not become too obsessed with thinking about the market and valuations.

While having more capital gives companies more options, this must not detract from a focus on the business.

“You can’t operate in the market thinking about the market. You have to operate by doing the right thing for the business. Markets, by their very nature, are fluid, dynamic and unpredictable. Anybody caught up in the whole valuation piece is going to find it tough because you can’t do anything about the situation once you’re in the market,” he says,

“Don’t get bogged down by market conditions, because you have to continue to drive your own script.”