Three former BRI Ventures and MDI Ventures executives have been detained in Indonesia over alleged unlawful funding disbursements.

Three new corporate VCs have been detained by the Indonesian authorities as the scope of the TaniHub investment fraud case continues to expand. The widening scandal, the latest of several that have rocked Indonesia’s tech ecosystem in recent months, shows the complications of corporate venturing at state-owned enterprises, where investors are responsible to both the government and its taxpayers.

Nicko Widjaja, founder and former CEO of Bank Rakyat Indonesia’s BRI Ventures unit, was detained by South Jakarta District Prosecutor’s Office last week along with William Gozali, BRI Ventures’ former vice-president of investments, and Aldi Adrian Hartanto, former VP of investments for Telkom Indonesia’s MDI Ventures subsidiary.

The detentions are related to allegations of corruption and money laundering concerning $25m invested by MDI Ventures and BRI Ventures in TaniHub, the now-defunct Indonesian operator of an online platform directly connecting farmers with customers, between 2019 and 2023.

The investigation centres on the alleged diversion of part of that investment by TaniHub executives for personal use and the unlawful approval of disbursement of funds by investors. MDI Ventures CEO Donald Wihardja was detained in July together with TaniHub’s former president Ivan Arie Setiawan and Edison Tobing, a former director at the company. All three remain in custody.

Widjaja is accused of permitting an unlawful $5m investment by BRI Ventures in TaniHub in 2023, while Gozali and Hartanto analysed investment proposals for the startup as part of their duties. BRI Ventures led TaniHub’s $65.5m series B round in 2021, only for the startup to launch successive rounds of layoffs in the following months.

Indonesian authorities suspended the business licence of TaniHub’s lending affiliate, TaniFund, in May last year in connection with failures to meet regulatory requirements or minimum equity conditions, ordering it to liquidate at the same time.

Indonesia’s startup scene grew extremely quickly in the 2010s, and was boosted by CVC investment from state-owned enterprises which dominate the domestic corporate landscape and which were encouraged to emerging businesses.

Indonesia is unusually dependent on a corporate venture capital investors, which include BRI Ventures and MDI Ventures in addition to units representing corporates such as conglomerate Sinar Mas, telecom operator Telkomsel and financial services firms Bank Mandiri and Bank Central Asia. Mandiri, like Bank BRI and Telkom, is majority owned by the Indonesian government, adding an extra complication.

Investing from what could be seen as public funds has brought additional scrutiny to these deals, especially now that many of these startups have hit financial difficulties. Indonesia’s startups grew extremely quickly in the 2010s but they have recently struggled amidst the exodus of investment dollars away from consumer-facing startups to those focusing more on edge technologies.

While many of Southeast Asia’s economies are facing this problem, Indonesia is an outlier as its consumer-facing companies had more opportunity to grow due to its large population.

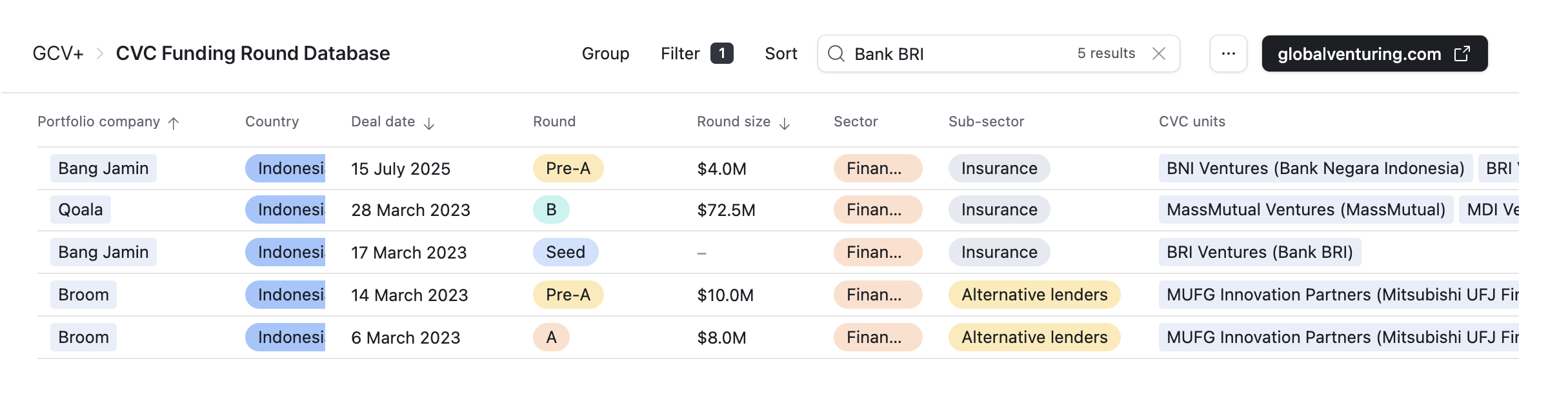

Investment rates have dropped off significantly from many of Indonesia’s core CVCs, according to GCV data. MDI Ventures invested in nine startups in 2023, but only four since then. BRI Ventures most recent investment, in insurtech startup Bang Jamin in July this year, was the first to be disclosed in approximately 18 months.

See all of BRI’s investments in Indonesia in the CVC Funding Round Database

TaniHub is only the latest Indonesian startup to get mired in scandal. The founder of aquaculture technology provider eFishery, which raised over $300m from investors including SoftBank, was detained last month as part of an investigation alleging that the company fraudulently inflated its revenue by hundreds of millions of dollars in 2024.

Elsewhere, financial services ‘superapp’ developer KoinWorks’ peer-to-peer lending subsidiary has been under investigation for alleged fraud since late last year. Online loan marketplace Investree’s former CEO, Radika Jaya, is currently at large, facing illegal fundraising charges.