Third-quarter investment numbers show that investors are more trigger-happy, but not recklessly so.

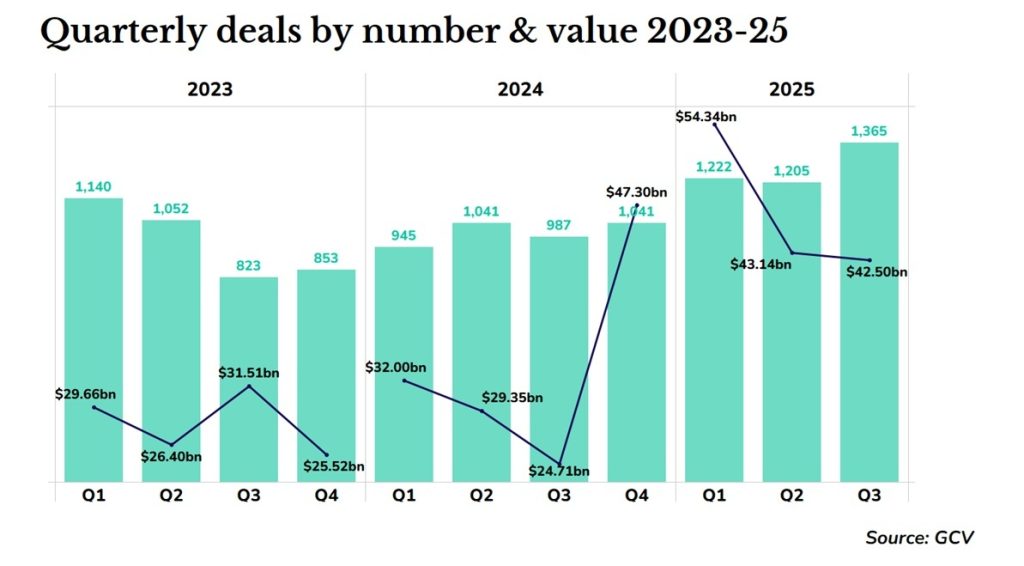

There have been more corporate-backed investment rounds in the third quarter of 2025 than any other quarter since at least 2023, and nearly a third more than in Q3 2024.

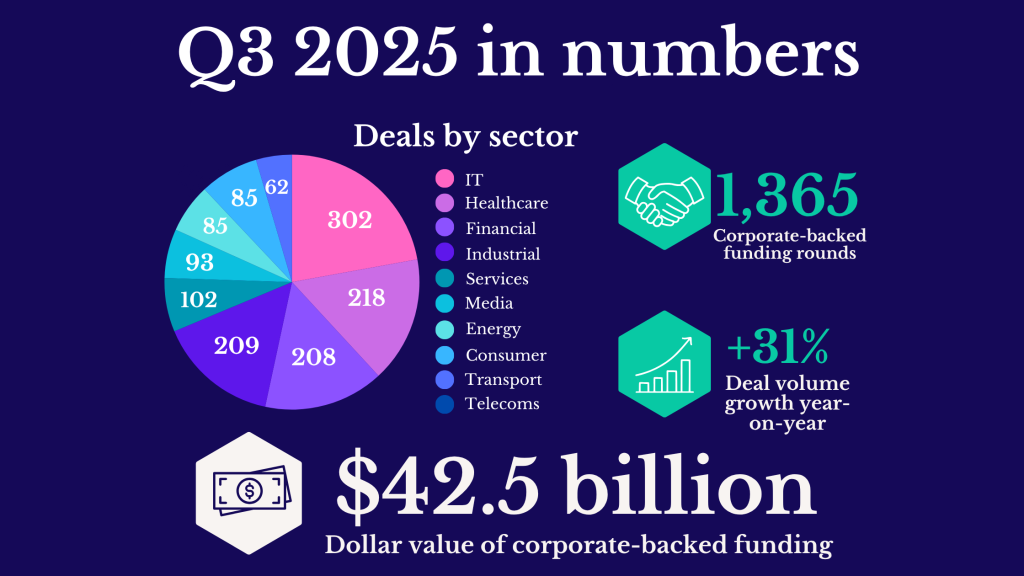

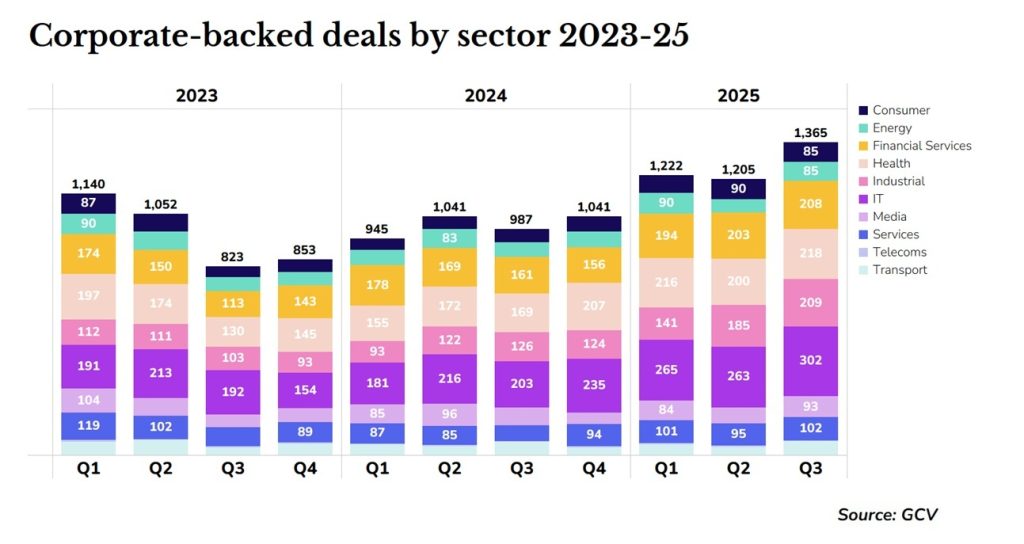

Corporate investment arms took part in 1,365 deals in the three months to the end of September, 31% up from the same period last year, although the value of those transaction is the lowest of any quarter this year. The transaction numbers are buoyed by big year-on-year increases in investments in IT and industrial sectors, both of which are seeing a huge amount of AI-related capital flow.

September was the biggest month of the quarter both in terms of deal flow and dollars invested – with the most deals and the fifth largest investment volume since 2023.

The mega-rounds in Q3, which collectively hauled in over $8.5bn, were dominated by AI startups. AI technology developer for human collaboration Thinking Machines Labs, AI-powered customer loyalty software developer Genesys, LLM developer Mistral, and AI infrastructure company Nscale all pulled in over a billion dollars. Only two startups, quantum computing company Psiquantum and humanoid robotics developer Figure, raised billion-dollar rounds outside the AI space. Meanwhile, all but one of the megarounds features Nvidia as a backer.

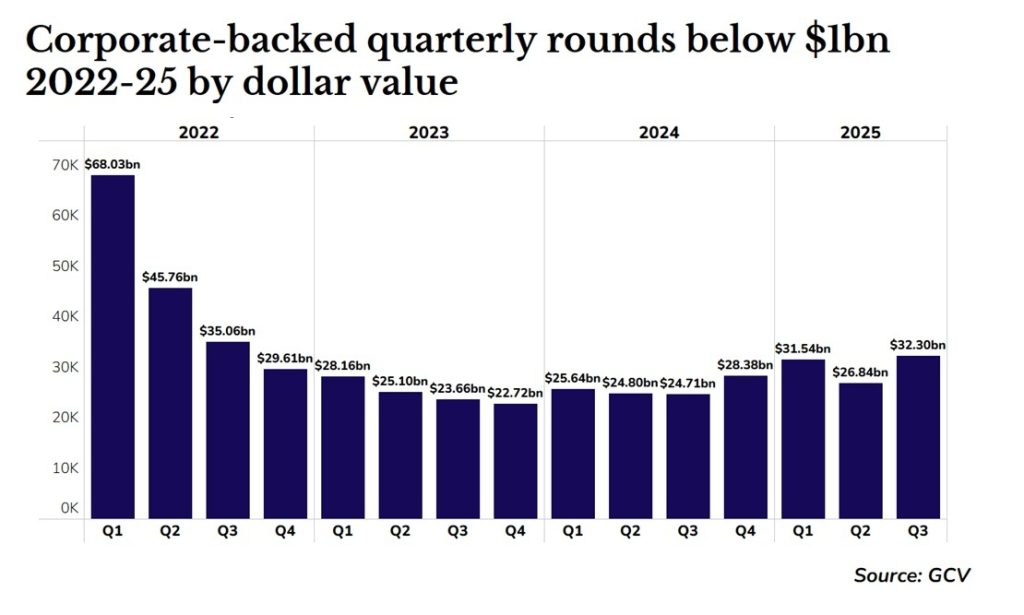

When you take out the billion-plus mega rounds, however, Q3 also emerges as the highest in terms of dollars invested since Q3 2022, when the venture market dropped substantially before levelling out. This shows that even without the outliers, investors are gaining confidence and steadily loosening the purse strings while still avoiding, even amid an AI gold rush, the same near-irrational firehose scenario seen post-pandemic with Web3.

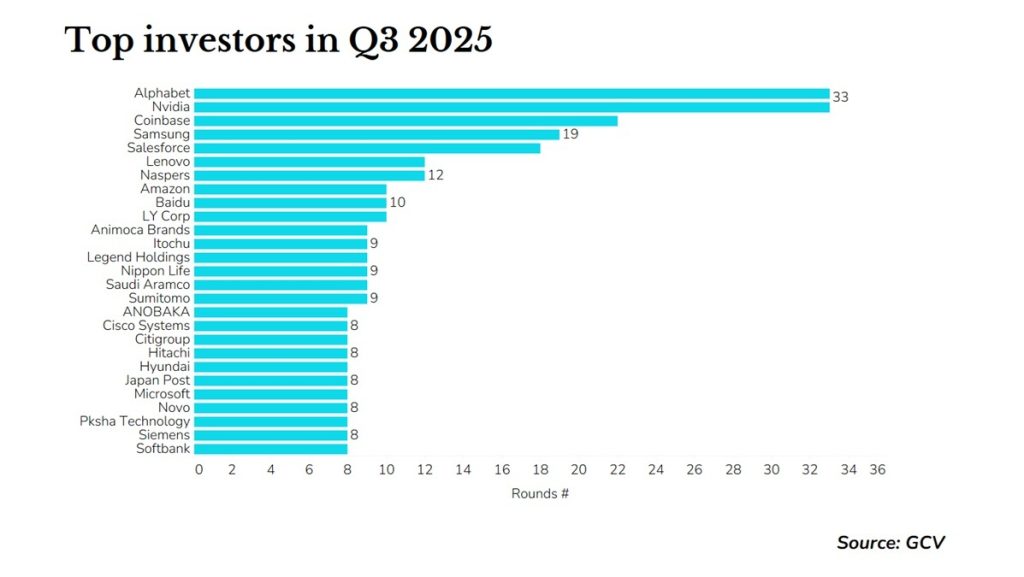

Alphabet and Nvidia were the two largest investors this past quarter. Nvidia, in particular, had an impressive showing – boasting in September alone the most startup investments of any corporate since the venture downturn in 2022.

Help us track CVC trends

By taking part in the annual GCV Keystone survey you can help us create benchmarking tools for the sector and identify industry best practice.

All answers are anonymised and all respondents receive a free copy of the benchmarking report.

Coinbase is not far behind with a deal count in the early 20s, followed by Samsung and Salesforce in the high teens. Of those top five investors, only Coinbase is mostly focused on a sector that is neither IT or industrial.

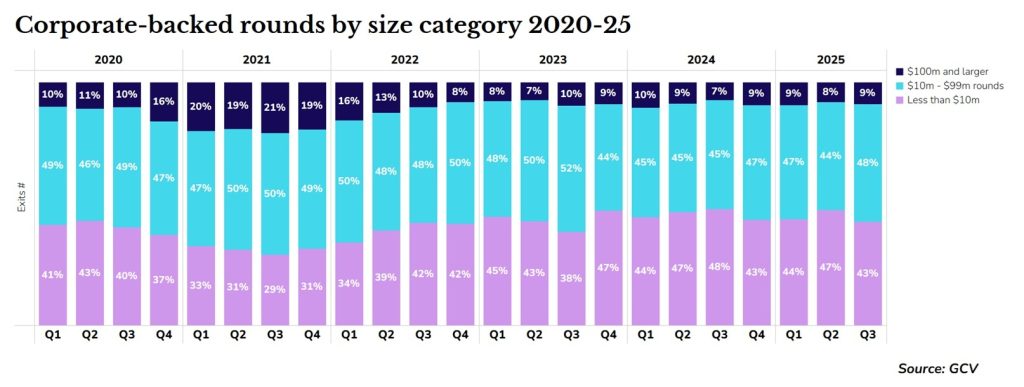

There has been no significant change in the general size of rounds over the past couple of years. The share of rounds exceeding $100m in value has not changed by more than three percentage points – hovering between 7-10% in any given quarter – since mid-2022 when the venture market cooled off.

The same is generally true for deals between $10m-99m in value and sub-$10m rounds, both of which have yoyoed within the same circa-5% range in the same time period. Q3 2023 was something of an outlier, but even then a negligible one.

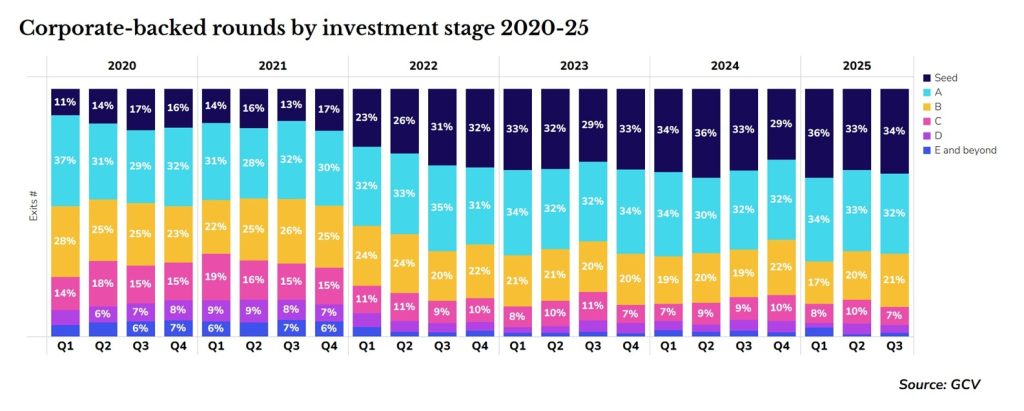

By a similar token, there’s been no meaningful difference in the stages that corporates have invested this quarter versus the same one last year, with no stage seeing more than a 2% difference. Seed and series A remain the biggest by far, each with just over 30% of the share, dropping to 21% at series B, 7% at series C and not much beyond that.

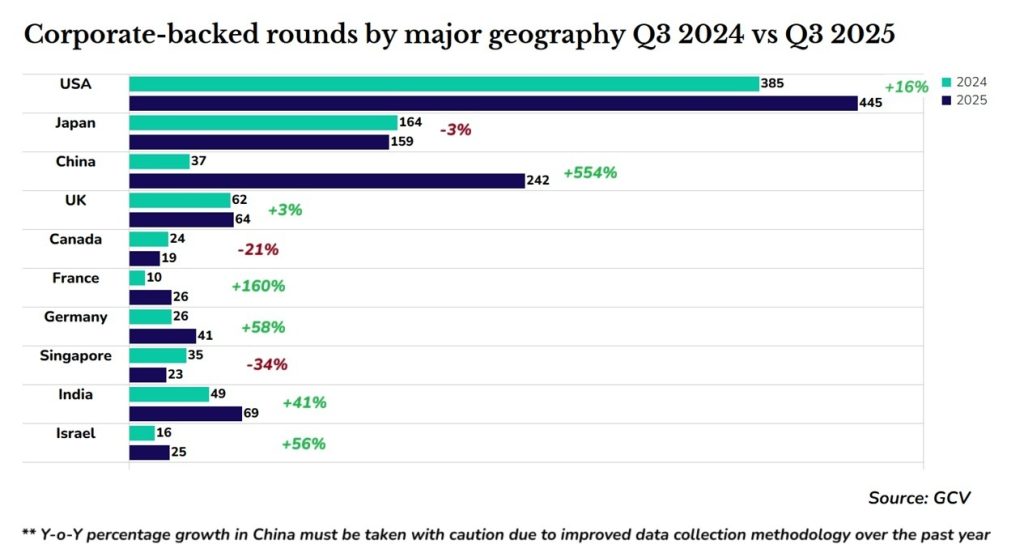

The US market, always the biggest globally, saw a 16% increase year-on-year compared to Q3 2024, going from 385 last year to 445 in Q3 2025.

Canada and Singapore saw big drops in percentage terms – 21% and 34%, respectively – but not necessarily huge in absolute terms. Everywhere else saw a bigger Q3 this year than last. France more than doubled its investment count, while Germany, the UK, India and Israel also saw their numbers lifted. China shows a massive increase of 554%, but at least some of that may be accounted for by improved data collection by GCV.

In absolute terms, Japan punched above its weight, as usual, with 159 investments in Q3, more than twice that of rapidly-growing India. LatAm, on the other hand, saw somewhat low figures – Brazil, as usual, leading the pack with 12 corporate-backed rounds, while Argentina had two and Mexico and Colombia each clocking one.

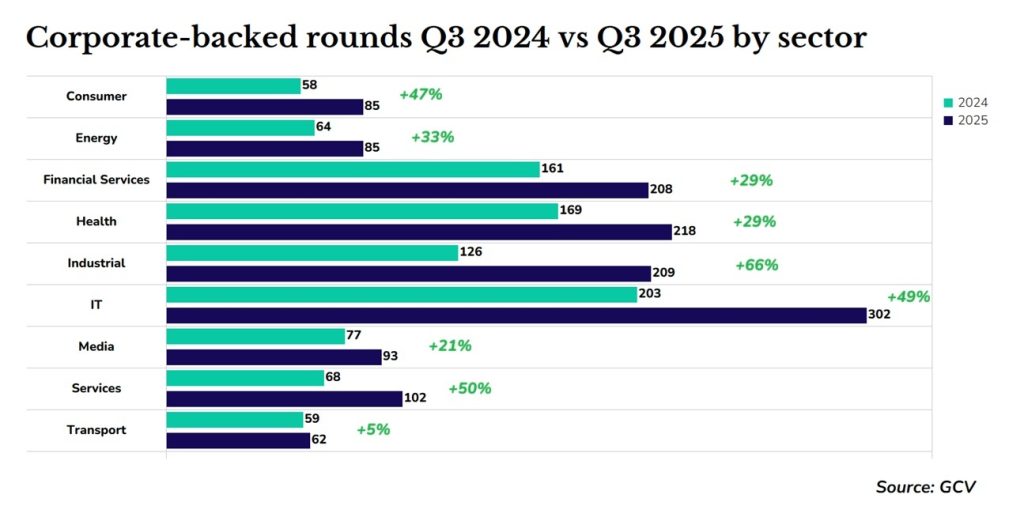

IT was by far the biggest sector in terms of deal flow with 302 rounds, clearing nearly a hundred deals compared to healthcare, which came in second with 218, while industrial and financial saw 209 and 208, respectively.

Compared to last year, there was an across-the-board increase in every sector. The smallest one was in transport, which saw three more investments that Q3 last year, an increase of 5%. Investments in media startups went up by a fifth, while services, IT and consumer went up by roughly half, and industrial investments increased by two-thirds relative to last year.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.