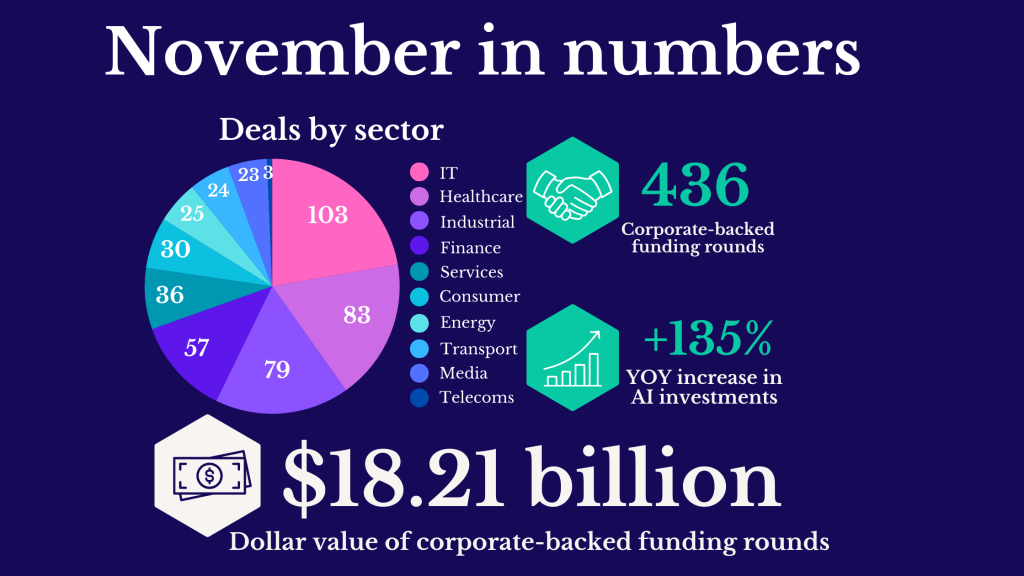

Entire sub-sectors ranging from autonomous vehicles to healthcare provision to wealth management saw at least double the corporate-backed funding rounds of the same month last year.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.