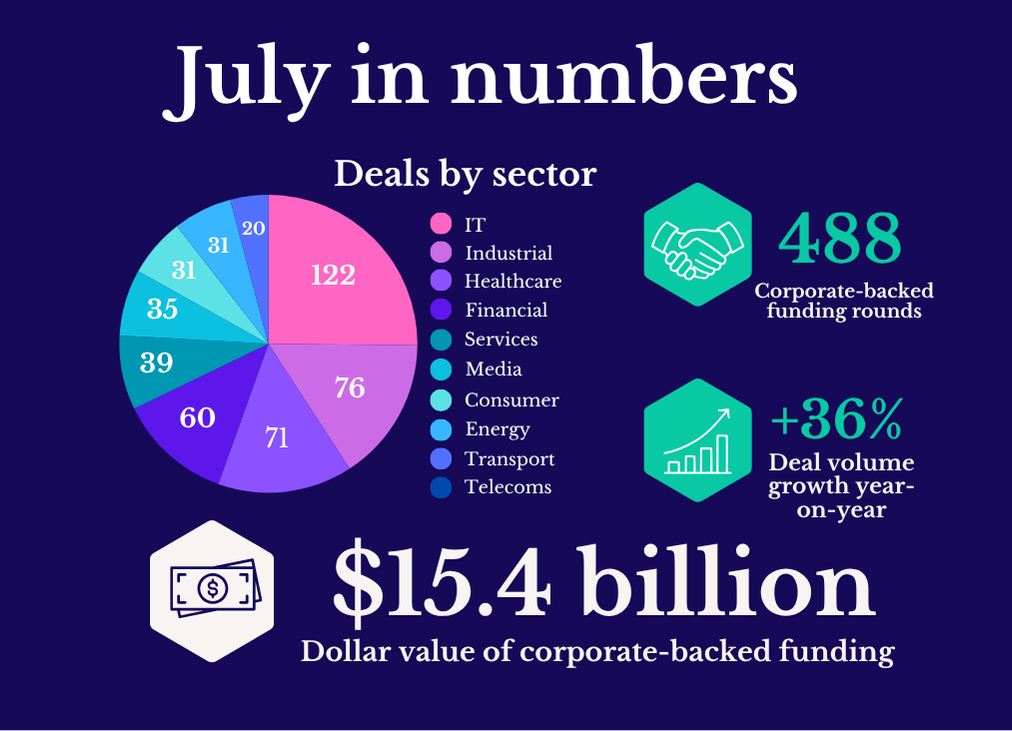

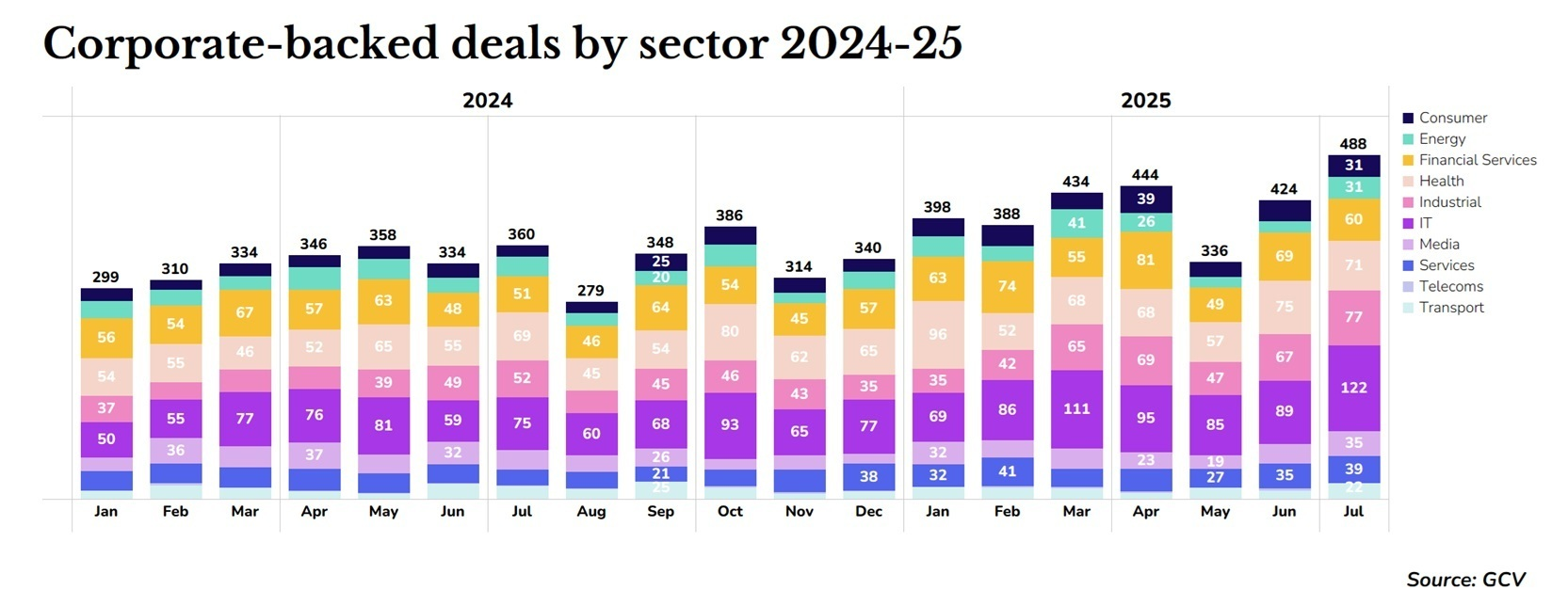

Increases in corporate-backed funding rounds in IT and industrial startups have driven dealmaking to a post-tech investment boom high in July.

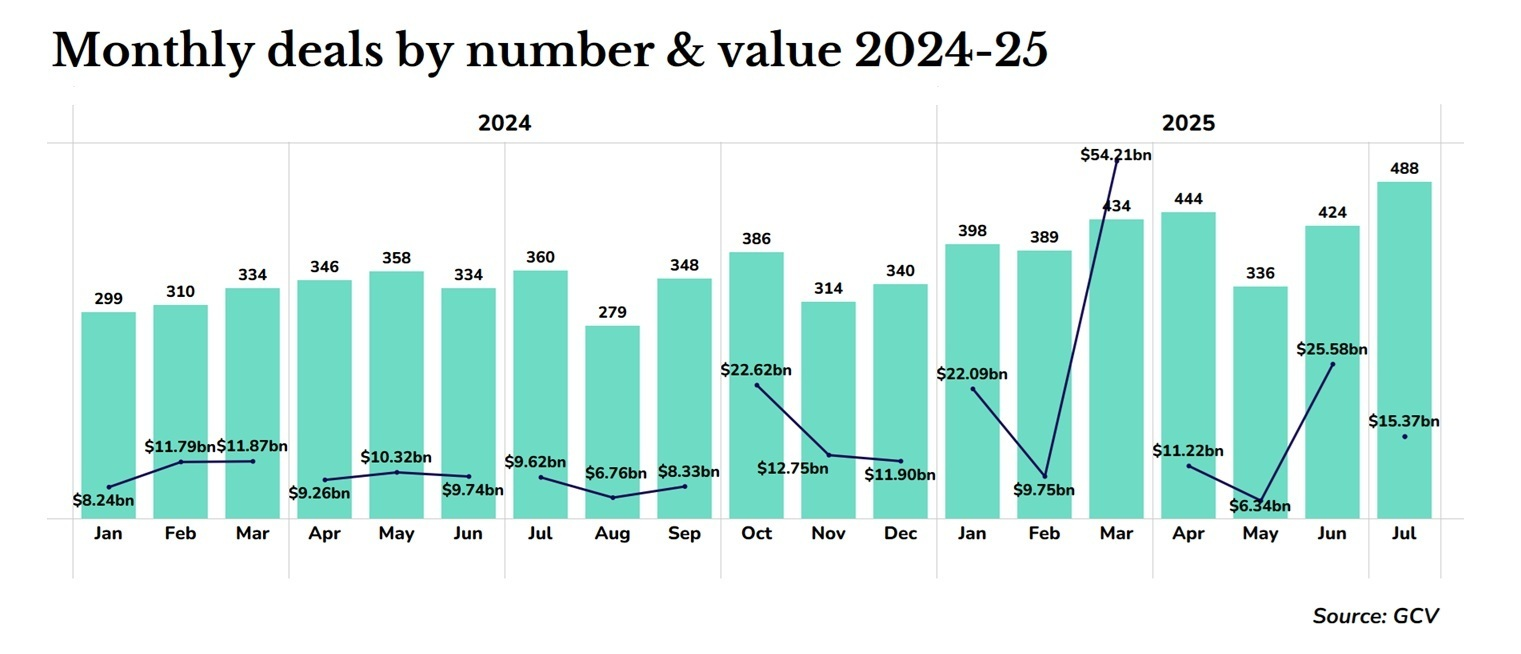

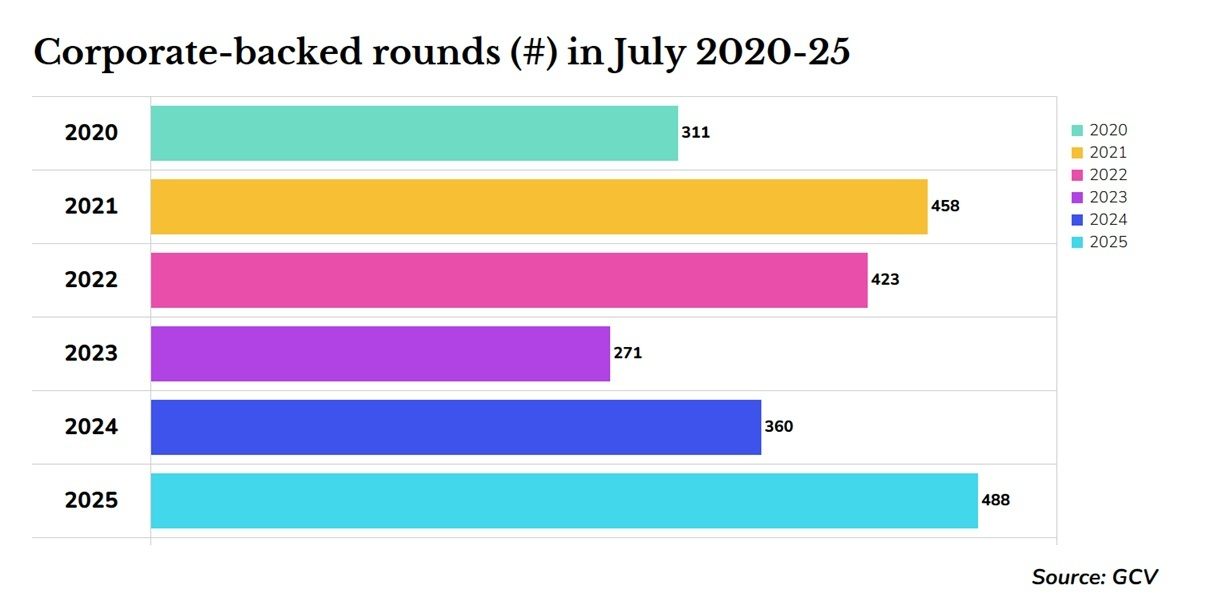

After an uncertain economic outlook following a brief dip in dealmaking in May, investors have recovered their optimism. In July, corporate-backed funding rounds reached their highest monthly level since the VC tech investment boom of 2021 and 2022.

March of the mega-round

The total value of funding rounds, where disclosed, was $15.4bn. This is higher than all the months of 2024 except one, but is not as high as January, March and June of this year, where extremely large AI startup rounds distorted the total.

The largest deal was the $2bn seed round for Thinking Machines, a US AI startup run by OpenAI’s former CTO Mira Murati. Although the company has not publicly announced what it is working on, this funding has already lent it a valuation of $12bn. Corporate investors include chipmakers Nvidia and AMD, and technology company Cisco.

And it seems that mega-rounds are not unique to AI companies. China Fusion Energy, a company working on nuclear fusion technology, raised $2.1bn from investors. Unlike a typical startup funding round in, say, the US, this new company will be under state control as a subsidiary of the China National Nuclear Corporation. It does, however, draw on investment from a number of companies and university departments, which it will partner with as it works to commercialise Chinese fusion technology.

There is no nuclear fusion startup in the West that has received a comparable level of investment. Not surprisingly, this has sparked some concern from US-based competitor Commonwealth Fusion Systems, whose CEO wrote an op-ed for The Hill calling on the government to carve out more federal funding for fusion technology.

Genesys, a US software company that makes CX (customer experience) technology, received $1.5bn in investment from cloud companies Salesforce and Service Now, each contributing $750m to buy shares from existing equity holders. While not a typical VC round, there is a clear strategic element to the deal, with both investors indicating that Genesys’s technology will help enhance their AI offerings to business customers.

Hottest July on record

The total number of deals for July exceeded those for the same month in every year since 2020, even through the height of the tech investment boom of 2021 and 2022.

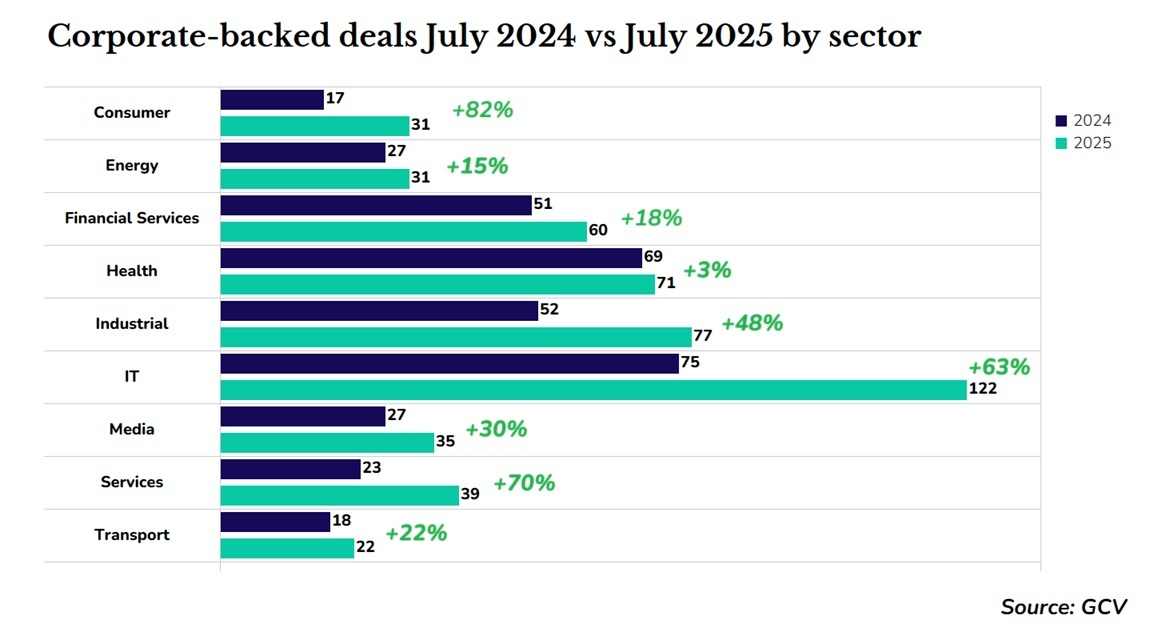

All sectors saw increased dealmaking activity compared with July 2024.

The services and consumer sectors saw the highest relative jumps in deal volume, albeit from a low base. In services, funding rounds for real estate startups made up a large proportion of this increase. One notable deal here was a $250m raise for Bilt Rewards, which provides a loyalty points systems for renters. Investors included the US mortgage lender United Wholesale Mortgage.

The highest absolute increases in deal volume were in the IT and industrial sectors, with more recorded than in any of the other months since the beginning of 2024.

In the IT sector, AI and semiconductor startups received the highest level of investment of any month this year. Half of the semiconductor funding rounds were for Chinese companies, including the AI chipmaker Transtreams. Developing domestic supply of AI chips remains a priority for Chinese corporates and policymakers.

Only two of these rounds were for startups in the US. One of which was the lithography machine developer Multibeam. Such technology, if commercialised effectively, would contribute to the country’s production onshoring efforts.

A large driver of the increase in industrial startup rounds was the interest in robotics and unmanned aerial systems. China’s industrial policy also made itself felt here, with 14 investments in humanoid robot or embodied intelligence startups. Two South Korean humanoid robot makers also raised rounds: Arobot and Robros, as did Japan’s Insol-High, which makes a support platform for implementing humanoid robot technology.

In Asia, the volume of deals for Chinese and South Korean startups reached their highest monthly values of 2025 so far at 92 and 31, respectively.

In South Korea, the largest funding round was for FuriosaAI, a chipmaker that makes GPU architecture. Tech conglomerate Kakao took part in the $125m raise. Illmis Therapeutics, a pharmaceutical startup making treatments for disorders affecting the central nervous system, raised $42m in a series B round.

In Europe, there were 92 deals in total. There were 21 deals for German startups, which is nearly double the figure for June. The largest of these was for the semiconductor maker Q.Ant, which raised $73.4m from investors including the chip manufacturer Imec. Schneider Electric participated in the $70m funding round for the supply chain sustainability company Makersite.

There were also 21 deals for UK startups, an increase on the past two months. The largest of these was the $133.3m funding round for Gridserve, which makes electric vehicle charging infrastructure, and had Mitsubishi participating. Since the startup’s founding in 2017 it has opened several charging forecourts across the country.

New high scores

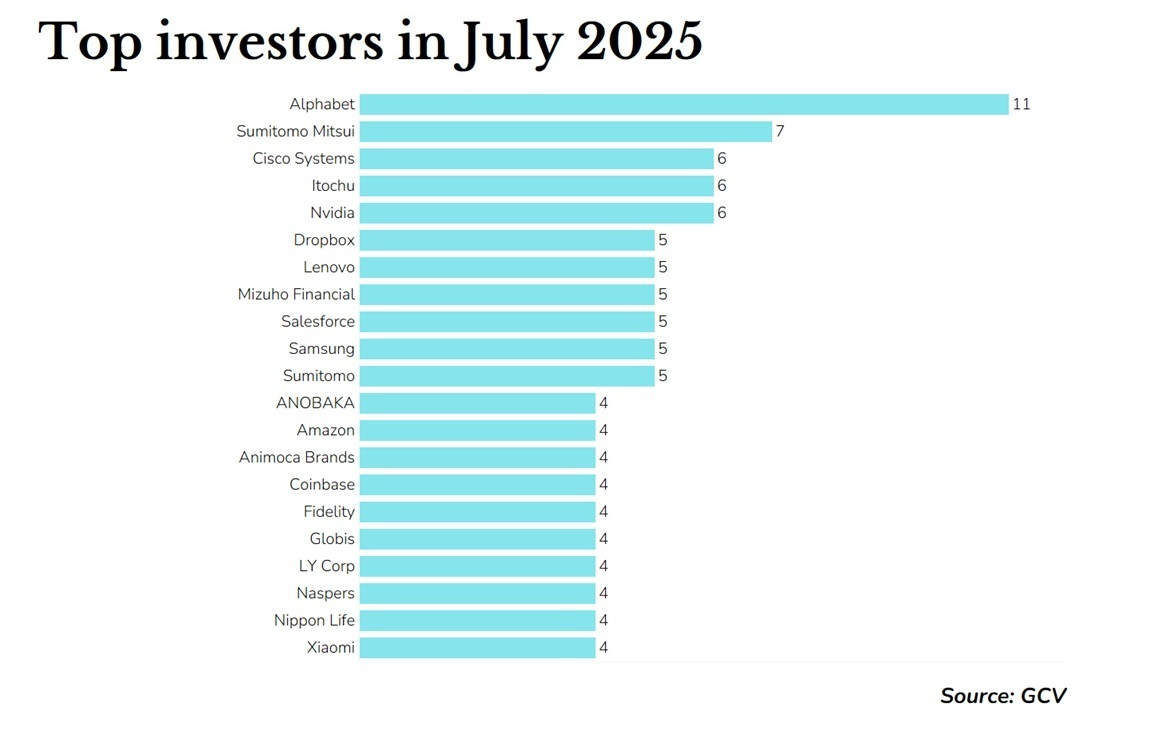

There were some unusually prolific investors in July, below the stalwarts Alphabet and Sumitomo Mitsui.

US tech company Cisco made six investments, suggesting quite an uptick, considering its Q2 total was eight. One of these was the $2bn Thinking Machines round. It also participated in the $37m series B funding round for Dropzone AI through its venture unit Decibel. Dropzone makes a cybersecurity system that issues autonomous alerts of threats. Cisco also invested, via Decibel, in E2B, which makes a sandbox environment for testing AI-generated code. E2B raised $11.5m.

Itochu, a Japanese conglomerate with businesses in several sectors including textiles, food and machinery, made six strategic investments in the month. These deals also span a diverse set of sectors. It took part in the $62m series C round for SkyDrive, a Japanese company making eVTOL flying cars. It also backed Logomix in its $18.6m funding round. The startup makes bioproducts based on cell engineering for industry applications.