Many of the new CVC units were launched by Asian corporates in Japan, China and Korea.

Around 57 corporations created new startup investment arms in 2025, a sign that corporate venturing continues to be popular as an innovation tool for large companies. That is a higher number than in 2024, when just 46 new CVC units were formed.

It is notable that most of the largest new venture units were created by Asian corporations, particularly in Japan, China and Korea. US companies have been far less active, with none of the largest new CVCs at a US business.

We have also seen a number of large Japanese corporations that already had investment arms, including Fujitsu, Mitsui Chemicals, TDK, Hitachi and Toyota, launch follow-on funds this year, substantially increasing the total amount of capital dedicated to startup investing. New capital commitments mean Hitachi and Toyota now have more than $1bn in assets under management. Earlier this month optics and medical technology company Olympus unveiled a second, $150m fund, triple the size of the first fund it had set up in 2021.

South Korean companies, too, were active, with gaming company Krafton joining with two other South Korean gaming companies, Naver and Mirae Asset, to form a $669m fund focused on India.

Others corporates that already had investment operations but which committed to new capital this year include French pharmaceutical company Sanofi, which added $625m to its evergreen fund, and UK-based investment bank Standard Chartered, which launched a $250m digital assets investment fund. Brazilian financial services firm Banco do Brasil more than doubling its CVC arm’s total capital to R$500m ($94m).

Deaths and divorces

This year has also seen the closure of several units, including the shock decision by German reinsurer Munich Re to shutter its $1.2bn Munich Re Ventures arm. A number of corporate venture units in Brazil are also understood to have closed, including retailer Cencosud’s venture arm, Oxygea, the CVC of petrochemical company Braskem, and Gerdau Next Ventures, the investment arm of steelmaker Gerdau.

A handful of corporate investment units also spun out from their parent companies. JetBlue Ventures, led by Amy Burr, separated from its airline parent and became part of Sky Leasing, an aviation investment management company. Nichola Bates made a similar move for the innovation team she had led at Boeing, taking it out of the aerospace company and joining with the Fifty Group, a transport sector investment firm.

Austrian insurance group Uniqa’s CVC, Uniqa Ventures, also spun out and rebranded as Shape Capital Partners, while Alphabet’s early-stage investment unit Gradient Ventures put distance between itself and its parent company. The move was designed to put Gradient in a more competitive market position for AI deals.

But overall the balance has been towards more corporate venture units being created than closing.

The largest new corporate investment funds created in 2025

Atlantic Vantage Point, €1.5bn

One of the largest new funds was a €1.5bn ($1.8bn) growth fund that is being raised by Atlantic Vantage Point, formerly known as Axa Venture Partners. This is one of the largest growth funds in Europe, where only a handful of VC funds — corporate or otherwise — have passed the $1bn threshold.

AVP started as Axa’s corporate investment arm in 2016 and then opened the fund to external limited partners from 2020. Axa is still an anchor investor in AVP and is understood to have committed $750m to the new fund. The European Investment Fund also joined as an anchor investor.

Gyeongbuk–Posco Innovation Growth Venture Fund, $730m

Another regional fund anchored by a large corporate investor was born in South Korea, where steel manufacturer Posco joined forces with Gyeongbuk province and four regional city governments to create an investment fund to back regional startups. It is the first time a large corporation has joined one of South Korea’s regional funds as an anchor. The fund is expected to focus on strategic industries such as advanced materials, secondary batteries, AI-driven manufacturing and green energy technologies.

MC Global Innovation, $700m

Japanese conglomerate Mitsubishi set up one of the largest new CVC units of the year when it created MC Global Innovation, allocating $700m to the vehicle. MCGI will invest from Mitsubishi’s balance sheet rather than from a dedicated fund but still represents a new focus and organisation to Mitsubishi’s investment activities. Before this, the company tended to just make ad hoc startup investments. Keeping up with the rapid advance of AI is one of the motivating factors for setting up the unit.

Sinopec hydrogen fund, $690m

China went large on hydrogen investment, with state-run oil and gas company Sinopec launching a 5 billion yuan ($690 million) CVC fund to invest in hydrogen energy startups. The fund will be managed by the Sinopec Capital subsidiary Sinopec Equity Fund Management.

China is the world’s leading producer of hydrogen and the government is pushing adoption of the technology, for example by funding the build-out of hydrogen fuelling stations.

Tokyo Invention Partners, $670m

Another large new fund came courtesy of Toyota, which not only committed another $800m to Woven Capital, doubling the size of its growth fund, but also created a completely new unit called Tokyo Invention Partners. This evergreen investment fund, with $670m in capital, will focus on backing early-stage startups in Japan.

Krafton-Naver-Mirae Asset Unicorn Growth Fund, $669m

South Korean gaming studio Krafton is launching an India-focused investment fund worth around $669m, in partnership with South Korean internet company Naver and South Korean financial services company Mirae Asset.

Krafton has long considered India its critical market and is believed to have invested more than $200m in the country’s startup ecosystem to date, mainly in social media and gaming companies. The new fund will take that commitment up another notch. Naver, on the other hand, has not be an active investor in India so far.

Sanofi-Cathay Pharmaceutical Innovation Fund, $275m

French pharmaceutical and healthcare firm Sanofi partnered with investment firm Cathay Capital to launch a $275m fund which will invest in clinical-stage drugs in China. Sanofi has had a partnership with Cathay since 2020, aimed at strengthening its position in China.

Later in the year, Sanofi also committed a further $625m to its main Sanofi Ventures investment fund, increasing the total capital to $1.4bn. Jason Hafler, the managing director at Sanofi Ventures, said new opportunities arising from AI were a key reason that the company wanted to increase its firepower.

Sanofi has been in a fortunate position to be able to reinvest in its CVC activities, as last year three of its portfolio companies were acquired for a total of $3.25bn, including the $1.4bn purchase of Alzheimer’s disease drug developer Aliada Therapeutics by AbbVie.

International Airlines Group, $210m

International Airlines Group set up a new, revamped venture fund with $200m in capital to spend over the next five years. While the British Airways parent company had already been taking minority stakes in startups over the years, there was no set fund size or cadence to the investments. Nacho Tovar leads the new fund, which will focus on tools such as AI and IoT that could help improve airline operations, as well as on sustainable aviation fuel.

Aviva Investors Venture & Growth Capital, $185m

Insurance and financial services group Aviva’s asset management business launched a venture capital fund with £150m ($185m) from its parent company. The fund is set up as an evergreen structure and will target four distinct areas: financial and insurance technology, healthtech, science and technology, and climate and sustainability. It will invest in the UK, North America and Europe, with a distinct bias towards the UK, where the corporate is based.

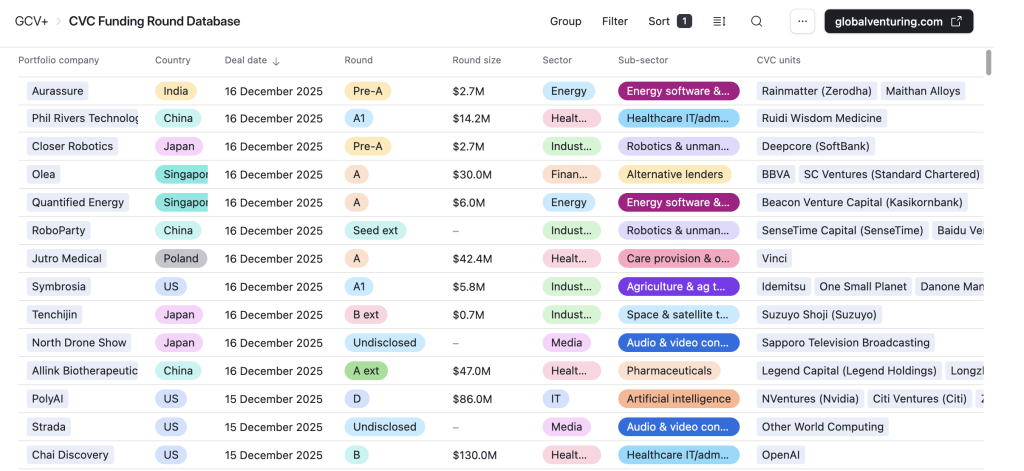

See all the corporate-backed startup investments from 2025 in the CVC Funding Round Database.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).