Prosus Ventures committed capital to e-commerce finance provider Wayflyer at a $1.6bn valuation, increasing its overall funding to over $236m.

Ireland-based operator of an online financing platform for e-commerce brands Wayflyer completed a $150m series B round, which included internet group Prosus that participated through its corporate venturing unit, Prosus Ventures. The round was reportedly raised at a post-money valuation of $1.6bn. It was co-led by DST Global and QED Investors, while investment bank JP Morgan, Left Lane Capital, Madrone Capital Partners and private investor Guillaume Pousaz also took part.

Launched in 2020, Wayflyer has developed a product that provides non-dilutive financing to e-commerce businesses, with a system of repayments based on their revenue activity, determined by using big data analytics. The size of its loans typically ranges between $10,000 and $20m. The company has experienced a 900% growth in cash advances year on year, and plans to use the proceeds from the latest round to provide more capital for clients and fuel expansion in markets including the United States and Europe as well as entering Asia.

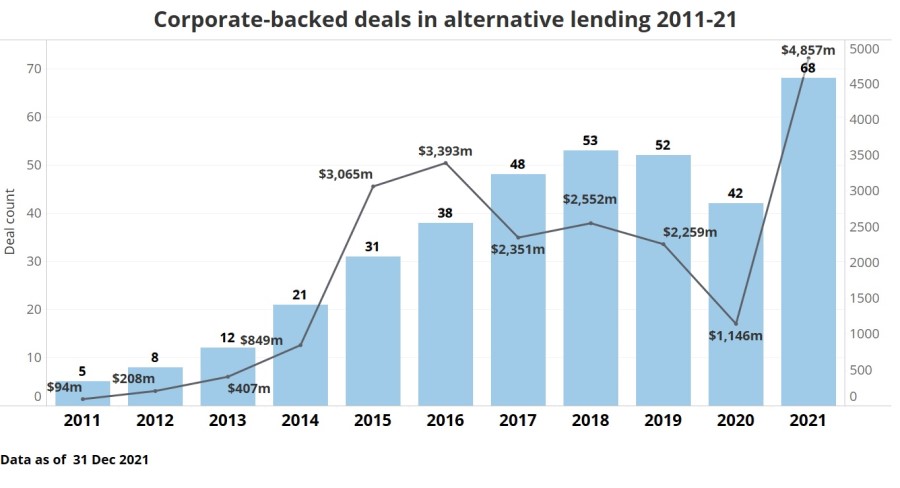

The company is part of the broader alternative lending space, which has piqued the interest of corporate venture investors over the years, as the GCV Analytics chart below clearly illustrates. The number of corporate-backed deals in this space had been growing steadily in the years leading up to the global covid-19 pandemic in 2020, when it went down. However, in 2021, the number of corporate-backed rounds reached an all-time high at 68 and so did the total estimated dollars at $4.85bn, which indicates that there has been upward pressure on valuations of such businesses. Whether this will continue going forward with monetary tapering around the corner is a hard question to answer. However, higher interest rates should, at least in theory, benefit lenders if inflation is under control.