Several China-based corporate venture investors backed a large round valuing lithium-ion battery Shanghai Shanshan material producer at $1.5bn. The deal highlights the importance of battery technologies not only for the emerging kind of mobility applications but for the process of energy transition as a whole.

China-headquartered lithium battery provider Ningbo Shanshan was among the investors that committed RMB3.05bn ($472m) in funding to its Shanghai Shanshan Lithium Battery Material Technology subsidiary. The round was filled out by electric vehicle manufacturer BYD and battery producer Contemporary Amperex Technology (CATL). Other participants included oil and gas supplier PetroChina’s Kunlun Capital unit and CATL-backed vehicle Wending Investment. The funding was reportedly raised at a $1.5bn valuation.

Launched in 2014, Shanghai Shanshan develops and manufactures lithium-ion battery anodes and carbon materials. Ningbo Shanshan itself began life as an apparel vendor in 1992 before eventually shifting its business to focus on energy transition.

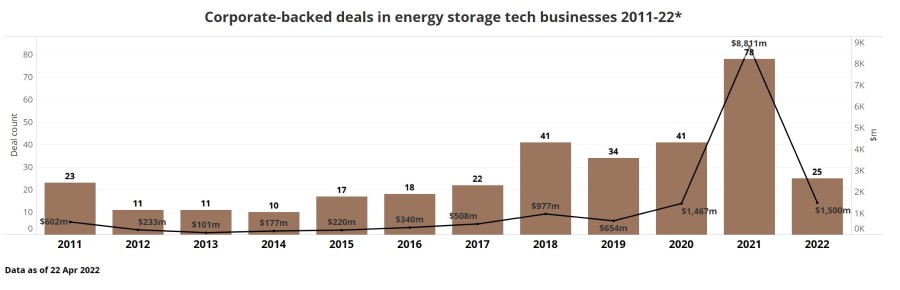

The company forms part of the broader energy storage tech space, which has enjoyed much interest from corporate venture investors over the past few years, as the chart below summarising GCV´s data illustrates. Last year, 2021, we saw a notable increase in both the number of corporate-backed deals in this space (78) versus previous years as well as the total estimated capital in those rounds, reaching a high of $8.83bn. In the transition to a net-zero world, energy storage is bound to play an instrumental role in facilitating the use of clean energy which is to ultimately replace fossil fuels.