The NEC-backed quantum computing system developer will list on the New York Stock Exchange. The company is part of the budding quantum computing tech space in which corporates are taking increasing interest.

Canada-based quantum computing technology developer D-Wave Systems, which counts IT equipment producer NEC among its backers, agreed to a $1.6bn reverse merger with special purpose acquisition company DPCM Capital. The deal valued the company at $1.2bn pre-merger and the merged business, D-Wave Quantum, will float on the New York Stock Exchange taking the place acquired by DPCM in a $300m initial public offering from late 2020. The deal was also backed by a $40m private investment in public equity (PIPE) financing provided by NEC, investment bank Goldman Sachs, PSP Investments, Yorkville Advisors and Aegis Group Partners.

Founded in 1999, D-Wave produces full-stack quantum systems supporting hardware, post-processing software and developer tools. The company’s technologies develop computing systems, that operates on a chipset using quantum annealing to solve optimisation problems for commercial use in logistics, bioinformatics, life and physical sciences, quantitative finance as well as electronic design automation.

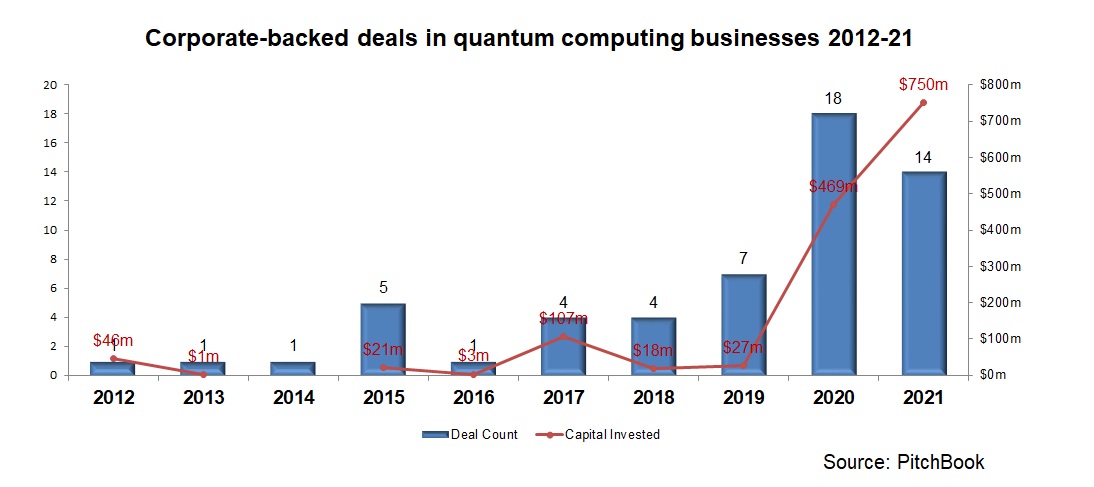

The company forms part of the quantum computing tech space, which is still relatively nascent but it has been on the radar of corporate venture capital investors, as the PitchBook chart below clearly illustrates. Corporate-backed rounds in such emerging businesses were few and far between prior to 2020 but interest appears to have grown considerably in this field since then. This interest will likely be sustained in the future due to the enormous disruptive potential of future quantum computers.