Citi Ventures, set up 15 years ago, was an early pioneer in corporate investing. This is what Arvind Purushotham, who set up the unit, has learned about bringing startups and big business together.

Over the past 15 years it has become much more common for large companies to invest in startups, with around a fifth of all startup funding rounds including a corporate backer. One of the pioneers of this trend was Arvind Purushotham, a former venture capitalist who set up an investment unit for Citi Group back in 2010, when the concept was still poorly understood.

Purushotham, who was previously at VC firm Menlo Ventures, admits initially he knew little about how a corporate venture team should function.

“I had never worked at a large financial institution prior to coming to Citi. So, in many ways, I didn’t know what I didn’t know,” he says. “We knew how startups work, how to look at technologies, how to look at trends. Then what we figured out is how to plug that into the business.”

Though Purushotham may have “figured out things along the way”, it seemed to work. Fifteen years on, Citi Ventures — a team of 17 investment professionals working from offices in the San Francisco Bay Area, New York, London, Tel Aviv, and Singapore — has made some 200 investments in startups and achieved 30 exits for those companies, including big stock market listings such as the IPO of Square in 2015 and DocuSign in 2018.

At the same time, he has seen the corporate venturing ecosystem grow up around him, becoming increasingly professional and effective.

“It’s really been a sea change. Corporates have figured out how to work with startups, what the collaboration ought to look like. It’s much more of a scaled industry relative to 15 years ago,” he says, adding “I think it will continue to increase.”

With technologies such as artificial intelligence rapidly changing industries, companies can’t afford not to have strategic stakes in startups, he says.

“I think every industry has now recognised the importance of what strategic investing brings to their corporations, and so they’ve become active,” he says. “The secular trend is up and to the right.”

The secret of longevity: close alignment with the bank

Though some Citi Ventures portfolio companies have gone on to reach multi-billion-dollar valuations on the stock market, a more important success metric for Purushotham is the fact that some 100 of the portfolio startups have ended up having commercial engagements with Citi business units. The portfolio has generated at least $200m in measurable benefits for the financial services group.

“The primary goal is to identify emerging capability and bring that into Citi to benefit our clients and customers.”

Making sure the CVC team brought in technology and insights into the bank was always the guiding principle.

“When we first started it, we said, Citi Ventures exists to capitalise innovation at Citi and Citi Ventures was thought of as an innovation group. And we’ve stayed true to that,” says Purushotham.

“The primary goal is to identify emerging capability and bring that into Citi to benefit our clients and customers. We want to drive partnerships with developing adjacent products and providing adjacent services. And finally, it’s thought leadership and learning from the market, which is, you know, probably of equal importance to the other two,” says Purushotham.

The Citi Ventures team makes a big effort to understand what is important to Citi’s business divisions.

“One of the things we do is to spend a lot of time with our businesses internally, so we are up to date on the strategy of the business unit, the problems that they’re looking to solve, so that we’re up to date on what different pockets of Citi may be interested in.”

Beyond simply knowing the organisational strategy, the team identifies “the specific people and the teams that are evaluating these things, the people that actually end up providing the budget and closing these commercial engagements.” This allows Citi Ventures not only to position the startups in their portfolio effectively, but “to help them navigate Citi in the right way” — an approach that benefits both the startups and the business units in Citi. “Having that alignment helps us connect the dots between what’s happening in the external startup ecosystem and what’s important to Citi,” says Purushotham.

Driving these kinds of commercial connections is one of the metrics the Citi Ventures team is measured on.

Steady amid the ups and downs of the VC market

This strong alignment has meant that, although Citi Ventures invests from the corporate balance sheet, meaning the company could pull the plug on finances at short notice, this has so far never happened.

The past three years have seen an overall dip in venture capital investment, with many corporate investors also slowing down or even winding down their operations. In contrast, Citi has continued a steady investment pace. In 2025, it made 30 investments, one of its busiest years to date.

“I think one thing that you’re seeing is this resurgence of fintech after a soft period for the last three or four years.”

“One of our philosophies as a team has been to be very consistent. Even if you go back to the 2023, 2024 timeframe, I don’t think we dropped off in the number of investments we were making. To some extent, we’re seeing the benefit of being in the market and making some of those investments now, as the market has come back,” says Purushotham.

AI, wealthtech, cards

Tech investment is picking up again in the financial services sector, he says.

“I think one thing that you’re seeing is this resurgence of fintech after a soft period for the last three or four years,” he says.

Partly it is down to banks rapidly adopting AI.

“This area of AI as it intersects with financial services is extremely rich. Financial services is fundamentally a digital business, whether you’re talking about how you engage with customers, how you attract customers, all the way to fraud detection and everything in between can benefit from AI.”

Citi Group as a bank has also focused on its wealth business, pivoting away from general retail banking in some geographies to focus on high net-worth clients. The Citi Ventures team supported that strategic shift with wealth tech investments, such as estate-planning platform Wealth.com and Endowus, a software for retirement and investment management.

Cards and lending have been an important area for Citi over the past two years, and will continue to be in 2026 and beyond. The unit recently backed the funding round of Mexican business credit card company Clara, for example. Purushotham is also interested in the application of AI in regulatory compliance.

As for the recent surge of interest in cryptocurrencies — what Purushotham prefers to call digital assets — he is taking a cautious view. Citi Ventures has backed some cryptocurrency companies such as BVNK, a stablecoin infrastructure platform, but it is not a key focus for the team.

“It’s gone through this boom-and-bust cycle over the last 10 years, with that winter period in 2023 and 2024 and then a resurgence this year. We’ve always had this approach of let’s wait and see what’s happening and make sure that we’re staying on top and doing research in these areas,” he says.

“Various business units across Citi are quite active when it comes to digital assets and tokenisation. We’ve not been super active there. What we have been doing is making sure that we’re making investments to support that strategy.”

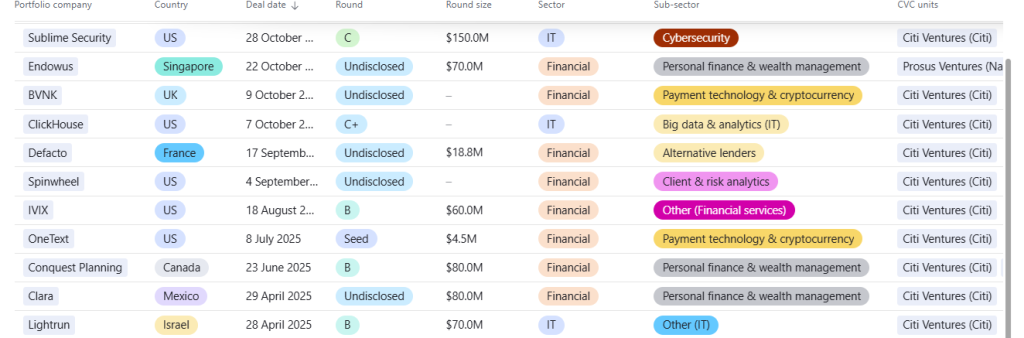

See all the recent deals by Citi Ventures in the CVC Funding Round Database

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).