Exit values are increasing, crypto funding has seen a resurgence and Singapore has seen a 60% year-on-year increase in corporate-backed funding rounds.

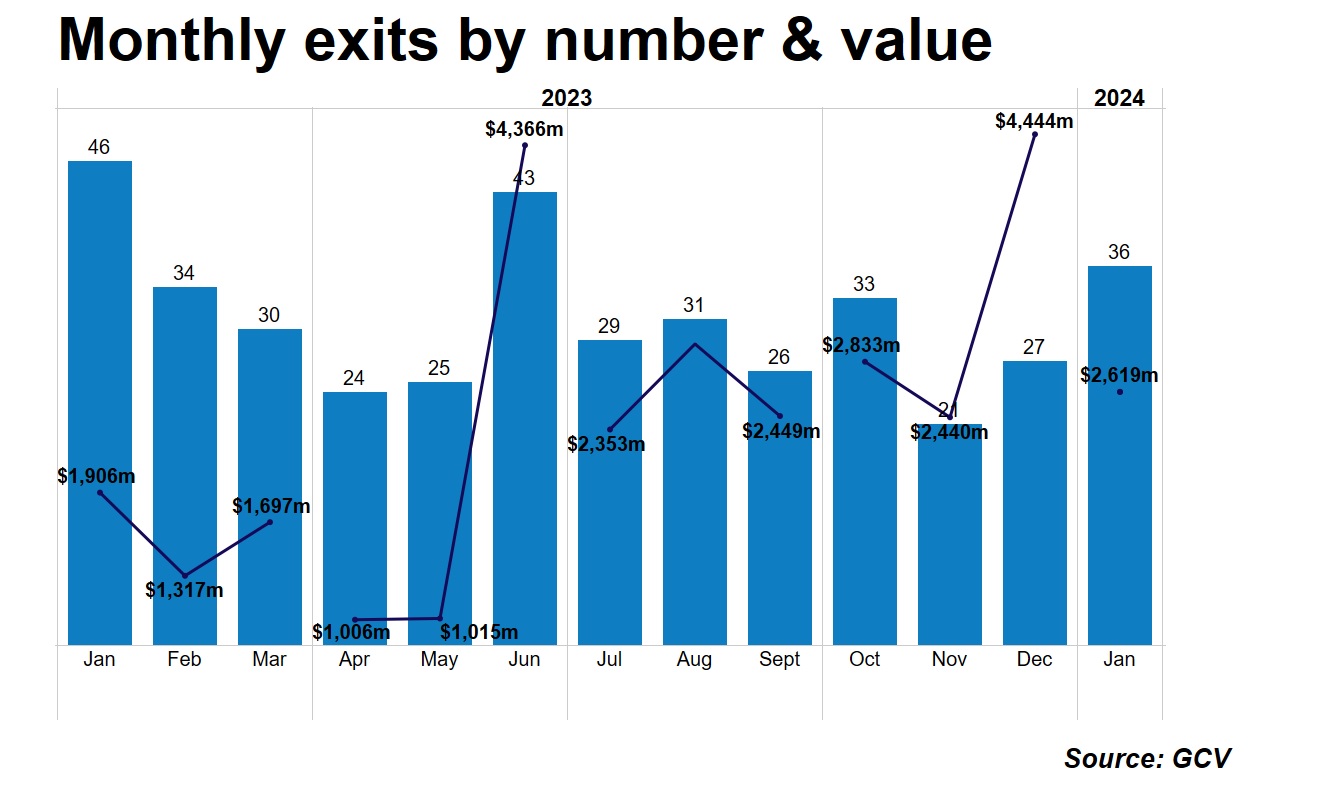

January saw a sharp jump in the value of exits achieved by corporate-backed startups, led by the completion of Visa’s $1bn acquisition of Brazilian banking company Pismo.

The number of deals was down year-on-year, with just 36 in January 2024, compared with 46 the previous January. However, there has been a continuing increase in dollar value of exits from the second half of last year. The fact that this is continuing into early 2024 indicates that this may more of a permanent shift than an anomaly.

Browse all the corporate-backed funding rounds from January 2024 in our dynamic table.

Corporate investors benefiting from the Pismo acquisition include SoftBank, Amazon and IT consulting firm B3. Another sizeable exit was AI edge computing company Blaize, which is heading for a Nasdaq listing through a combination with purpose acquisition company BurTech Acquisition Corp. The proposed transaction gives Blaize an enterprise value of $894m. Blaize’s investors include automotive groups Magna International, Mercedes-Benz and Denso.

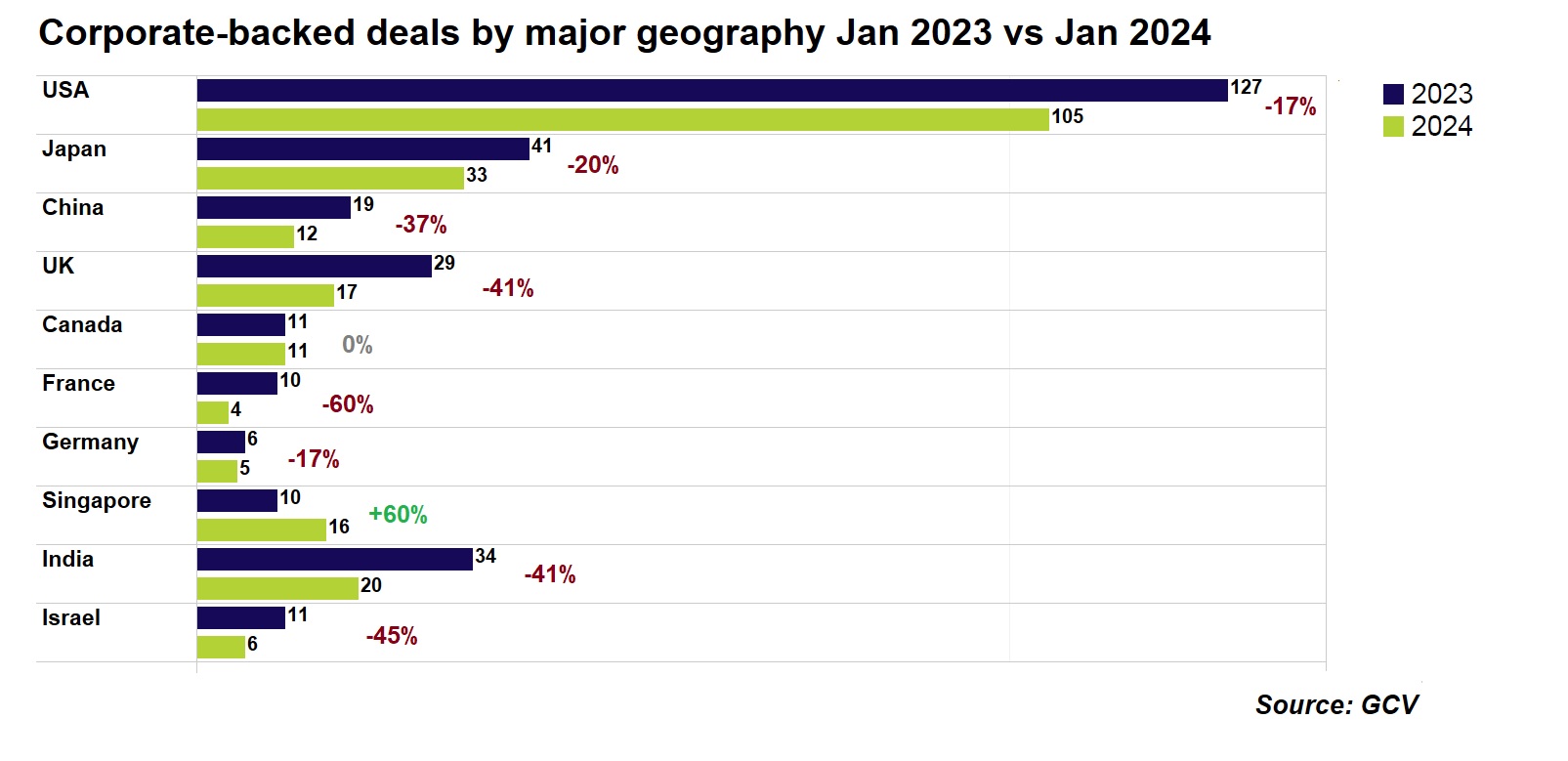

Funding rounds in Singapore rise by 60%

While every major geography saw a drop in the number of corporate backed startup funding round in January, apart from Canada, which stayed unchanged, Singapore has experienced a significant increase of 60% year on year.

The largest corporate-backed startup round in Singapore in January 2024 was that of semiconductor firm Silicon Box, which secured $200m in series B funding. The cash injection brought the company’s valuation to over $1bn, securing its status as a tech unicorn. The round featured several corporates, semiconductor companies UMC and Lam Research, IT company Tata Group and electronics corporation TDK, among others.

Global cryptocurrency company OKX invested heavily in Singapore in January 2024 through their CVC arm OKX Ventures. Of the nine funding rounds it took part in in January 2024, five were in Singapore. OKX contributed to web3 data analytics provider 0xScope V2’s $5m pre-A round, as well as funding rounds for Matr1x, a cyberpunk-themed esports platform, web3 venture studio BeWater, as well as several others.

Crypto activity continues

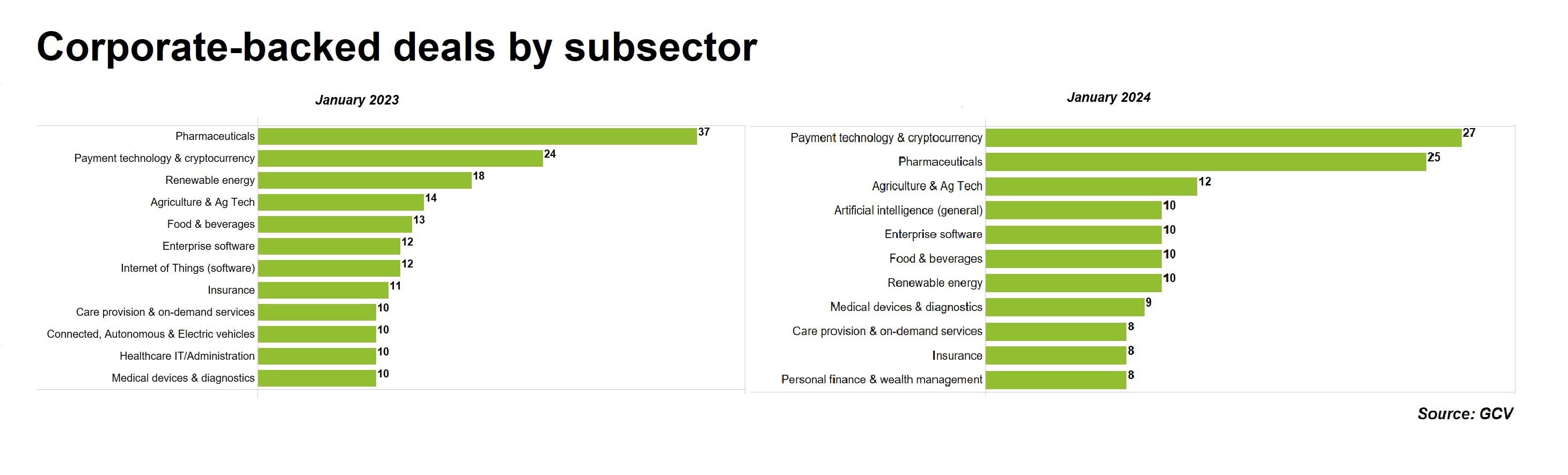

Partly due to OKX’s big month, cryptocurrency one of the busiest sub-sectors for funding rounds in January. There were more deals in January 2024 than January 2023 and cryptocurrency has even overtaken pharmaceuticals in terms of activity.

The largest deal in this sphere was a partnership forged between OKX and digital financial services Hashkey Group, intending to promote compliant virtual asset innovation.

Pharmaceuticals continued to see a large number of corporate-backed funding rounds. The biggest round of the month came from antibody drug developer LegoChem Biosciences, which secured $411m from confectionery company Orion to expand its R&D pipeline.

Cardiovascular disease and ophthalmology drug developer Ji Xing Pharmaceuticals also secured $162m of series D funding, co-led by Bayer’s CVC arm Leaps by Bayer.